1. Introduction. – 2. The Country of Origin Impact on Consumer Perceptions and Decision-Making. – 3. Consumer Behaviour in the Context of COO and Country Image. – 4. Legislative Implications of "Made in ..." Labels. – 5. The European Pharmaceutical Legal and Regulatory Landscape. – 6. Research Methods. – 7. Factors Affecting "Made in Ukraine" Pharmaceuticals in the German Market: Desk Research Analysis. – 8. German Attitudes and Purchasing Behaviour toward Ukrainian Medicine and the Country: Survey Analysis. – 9. Conclusion.

ABSTRACT

Background:The favourable perception of Ukraine, bolstered by global support during the full-scale Russian invasion of Ukraine, has profoundly influenced the country's national brand. This has increased receptiveness towards Ukrainian products, particularly in Europe and North America. These perceptual shifts have yielded notable ramifications for Ukraine's export patterns and trade dynamics. This article investigates the relationship between the positive perception of Ukraine, the "Made in Ukraine" concept, and the consumption of Ukrainian goods. It specifically emphasises the impact of the country of origin on consumer perceptions and decision-making processes. By examining these factors, the study endeavours to enrich the comprehension of consumer preferences while furnishing practical insights relevant to Ukrainian brands engaged in international markets. The research findings contribute to the existing literature on a nation's image, national branding, and consumer behaviour. Furthermore, they offer invaluable guid- ance for Ukrainian enterprises seeking to leverage their national brand and promote "Made in Ukraine" products globally.

Methods:The research methodology encompasses a two-stage approach that includes desk re- search and a survey to investigate the external environmental factors and comprehend German residents' attitudes and purchasing behaviour regarding Ukrainian pharmaceutical products. The formulated research questions aim to reveal the drivers behind product choices and perceptions of Ukraine as a nation. Several factors, including the established Ukrainian pharmaceutical industry, the potential for increased support and investment, geopolitical dynamics, the demand within the German healthcare system, and future growth opportunities, underpin the German market selection as this study's focal point.

Results and conclusions:The desk research analysis has identified numerous market oppor- tunities available to Ukrainian pharmaceutical manufacturers in the German market. These opportunities encompass leveraging the COVID-19 crisis, addressing medicine shortages, and strategically targeting specific demographic segments. The survey analysis, on the other hand, sheds light on the motivations and attitudes of Germans toward Ukrainian pharmaceutical products. It highlights the significance of doctors' prescriptions and pharmacists' influential recommendations. The survey indicates a strong willingness among Germans to support Ukraine by purchasing its pharmaceutical offerings. To harness Ukraine's positive perception in the Ger-man market, Ukrainian manufacturers should proactively implement communication strategies and cultivate robust relationships with healthcare professionals. They should focus on augment- ing their product portfolio and optimising supply chain efficiency while raising awareness and collaborating with pertinent stakeholders. Ultimately, this study underscores the potential for Ukrainian pharmaceutical manufacturers to leverage the favourable perception of Ukraine within the German market, offering invaluable for successful market entry and sustainable growth.

1 INTRODUCTION

Russia's full-scale invasion of Ukraine in February 2022 garnered unprecedented global attention, resulting in a surge of support from most countries worldwide. This heightened international focus on Ukraine positioned the nation as a symbol of heroism and a defender of freedom and democratic values, thereby strengthening its national brand on a global scale.1 This heightened global awareness of Ukraine has positively impacted the perception of Ukrainian products and brands. Research conducted by Bloom Consulting2 on the impact of the Russia-Ukraine war on national brands reveals that North America and Europe have witnessed a significant shift in the attitudes of respondents. About 80% of respondents now hold favourable views of Ukraine, while around 15% maintain a neutral perception in light of the conflict. In Asia and Africa, the impact has been less pronounced. The research fur- ther indicates that the war has had a constructive impact on Ukraine’s overall global image, with 54% of respondents believing that the conflict has enhanced Ukraine's appearance on the world stage.

Data from the R&D Centre, You Control,3 highlights substantial shifts in Ukraine's export relationships with other countries, reflecting notable changes in global perception. Poland has emerged as the foremost destination for Ukrainian exports, surpassing China, which held the top position in 2021 but dropped to fourth place because of the ongoing conflict. In the initial ten months of 2022, Ukrainian exports to Poland amounted to over USD 5.6 billion, constituting 15.4% of the total export volume. Traditional consumers of Ukrainian goods, including Italy, India, and Egypt, have witnessed a decline in their import shares. Notably, Ukraine's official exports to Russia categorised as an aggressor country, have sharply declined, resulting in Russia's drop from fifth to twentieth position in the ranking of export destinations. These shifts in export patterns underscore how support for a nation can profoundly shape its perception and trade dynamics, particularly during times of war.

This article delves into the interplay between the enhanced global perception of Ukraine resulting in the Russia-Ukraine war, the promotion of national brands under the "Made in Ukraine" concept, and the diffusion of local goods consumption. By examining Ukraine's inspiring narrative and national image, the study seeks to determine whether the favourable attitude towards Ukraine translates into tangible support for its products. The research aims to uncover the opportunities and challenges Ukrainian pharmaceutical products face as they attempt to capitalise on the strengthened national brand. This research contributes to the existing literature on country image, national branding, and consumer preferences. The research findings yield practical implications for Ukrainian brands seeking to harness the favourable global perception of Ukraine within international markets.

2 THE COUNTRY OF ORIGIN IMPACT ON CONSUMER PERCEPTIONS AND DECISION-MAKING

Numerous studies have underscored the profound impact of a product's Country of Origin (COO) on consumer perceptions and its overall success in the international market (G. Er- ickson et al., I. Nebenzahl and E. Jaffe, M. Thakor and C. Kohli, G. Balabanis and A. Diaman- topoulos, J. Pharr, T. Aichner, J. Polfuß).4 The COO concept pertains to the country in which a product is manufactured or with which it is closely associated, serving as a reference point for consumers when assessing products labelled "Made in...". Research by E. Kipnis et al.5 has revealed that the COO effect is deeply rooted in consumers' strong emotional product preferences. Consumers often harbour preconceived notions regarding product quality, reli- ability, and authenticity based on the COO. Various factors can influence these perceptions, including a country's reputation for producing specific types of goods, historical associations, cultural stereotypes, and economic or political considerations.

The COO can evoke specific emotions and associations, potentially influencing consumers' emotional connections and ethical considerations, ultimately impacting their purchasing decisions. A study by P. Verlegh and G. Steenkamp6 highlights the multifaceted nature of the COO effect, emphasising its cognitive, affective, and normative dimensions that shape consumers' preferences and choices. Within this framework, the affective dimension of the COO effect involves consumers associating the COO with status, identity, national pride, and past personal experiences. On the other hand, the normative dimension encompasses consumers' preferences through ‘customer voting,’ whereby purchasing or avoiding products from a particular country is seen as a way to either support or oppose the policies and prac- tices associated with that specific nation.

A substantial body of research has examined the phenomenon recognised as the ‘home country bias,’ whereby consumers prefer domestically manufactured goods over foreign alternatives, a tendency observed across various product categories and geographic locations (P. Hud- dleston et al., Z. Ahmed et al., G. Balabanis and A. Diamantopoulos, L.-A. Casado-Aranda et al.).7 Concurrently, the literature indicates a significant increase in consumers' intention to purchase products bearing the label “Made in Domestic Country” (Y. Bernard et al., A. Yu et al.).8 Previous studies have also highlighted the role of specific emotions, such as consumer guilt, in shaping attitudes toward foreign-made products (S. Mishra et al.).9 Consumer guilt refers to an emotional state of remorse experienced by individuals when their behaviour conflicts with personal and societal norms (M. Burnett and D. Lunsford, W. Fan et al.).10

Many studies have delved into the intricate dynamics that govern consumer decision-making regarding domestic and foreign products. Prior research has consistently identified ethno- centrism as a fundamental factor contributing to the home country bias (G. Balabanis and A. Diamantopoulos, T. Shimp and S. Sharma).11 S. Mishra et al. delve into the interplay between consumer ethnocentrism, patriotism and their combined impact on consumers' intentions to purchase domestic products.12 Their study illuminates the motivational role played by patriotism, which acts as a driving force encouraging support for domestic manufacturers. Purchasing domestic products is seen as a patriotic duty, symbolising loyalty to one's home country (C. Han, S. Mishra et al.).13 S. Carvalho et al.14 contribute to understanding how consumers' alignment with national symbols or rhetoric can influence their consumption behaviour. Their research emphasises that individuals' perception of external threats heightens their sense of national identity, intensifying positive emotions, stronger identification, and a more profound attachment to their home country.

However, certain academic studies present a counterargument to the presumed positive influ- ence of employing the COO concept in promoting domestic products. J. Polfuß15 conducted case studies on Chinese companies and concluded that only a few internationally oriented brands from China actively communicate their Chinese origin in their brand management. Notable exceptions include brands that consistently incorporate Chinese references in their names, like Air China. Polfuß also underscores the potential risk of differentiating brands through country-based branding, wherein unexpected political changes may impede brand communication or even work against it.

In the context of consumer behaviour, N. Nguyen et al.16 explore how a country's image influences consumer purchasing behaviour, specifically among Vietnamese consumers and their preferences for imported Chinese goods. Their findings illuminate a positive correlation between the perceived image of a country and Vietnamese consumers' intentions to purchase Chinese imported products, indicating the substantial role played by a nation's image in shaping consumer preferences and decision-making processes. However, the research also highlights the negative influence of consumer ethnocentrism on the perception of a country's image and subsequent purchase intentions.

Contrary to ethnocentrism, the research conducted by E. Kipnis et al.17 identifies cases where consumers exhibit positive attitudes toward foreign brands. In these scenarios, consumers tend to favour foreign brands recognised for their societal contributions and positive impact on the community's well-being. This discovery suggests that ethnocentric tendencies do not solely drive consumer preferences, and consumers can embrace foreign brands that align with their values.

3 CONSUMER PURCHASING BEHAVIOUR IN THE CONTEXT OF COO AND COUNTRY IMAGE

Expanding on the COO theory, the literature suggests that consumers' evaluations go be- yond considering product attributes and encompass a broader association with the COO. This indicates that consumers are influenced by factors beyond the product itself, assum- ing a more holistic perception of the originating country. J. Pharr18 argues that traditional product-specific evaluations related to the COO are evolving into a more comprehensive concept known as ‘country image.’ This multidimensional construct incorporates cognitive, affective, and conative components, aligning with the country where a global brand has historical or developmental ties.

G. Balabanis and C. Lopez19 investigate the factors that shape consumers' evaluations of a country's image, delving into the theoretical underpinnings and various motivations driving their purchase decisions. The study reveals that consumers have diverse reasons for choos- ing products from a particular country. These motivations span a spectrum, ranging from economic advantages and associations of prestige with certain countries' products to the desire to reduce uncertainty about product quality or to express solidarity with the country. Similarly, W. K. Li and K. B. Monroe 20 suggest that individuals consider specific products for authenticity, exoticness, patriotism, personalisation, or enhanced social standing. T. Aichner21 asserts that companies benefit from a country's good reputation and suffer from its poor reputation. Companies can employ "Made in..." labels, quality and origin labels, written and spoken language, symbols, landscapes, buildings, flags, and famous or stereotypical individu- als associated with the COO to communicate their origin to customers.

The ‘COO warmth’ concept has also emerged to understand a country's image. A. Maher and L. Carter22 define perceived warmth as friendliness and sincerity directed towards out-groups. C. Barbarossa et al.23 expand on this concept, introducing ‘COO warmth’ as a cognitive ap- praisal encompassing a country's friendliness, cooperativeness, and trustworthiness. This appraisal is influenced by the historical and contemporary cultural, political, and economic relationship between the foreign country and the consumer's own country. A. Diamantopoulos et al.24 further demonstrate a direct correlation between a country's warmth and competence and a brand's perceived warmth and competence.

Furthermore, studies indicate that consumers' perception of a country's personality traits can significantly shape their evaluations of brands associated with that country. A. Maher and L. Carter25 found that affective country attitudes, such as contempt and admiration, are related to consumers' willingness to purchase American products. P. Magnusson et al.26 support the idea that a country's warmth and competence positively impact admiration, and a country's personality traits have a tangible influence on consumer assessments of brands connected to that country. T. Motsi and J. E. Park27 examine the effects of national stereotypes on a country's overall image and specific product-related outcomes. Their findings suggest that the perception of warmth, associated with a country’s stereotype, can effectively promote tourism. Additionally, the study underscores the substantial role of national stereotypes in shaping perceptions and consumer behaviour regarding countries and their products.

While extensive research has explored the influence of COO and country image on con- sumer behaviour, there has been limited investigation into the effects of war and adverse circumstances on consumers' purchasing behaviour. Studies focused on moral emotions associated with COO have found that consumer animosity towards a particular country can trigger feelings of anger, subsequently leading to avoidance or boycotting products from that country.28 In this context, H. Hino29 explores the influence of moral emotions on consumers' attitudes toward purchasing Israeli goods, suggesting that anger towards Israel significantly influences the intention to boycott such products. However, empathic concerns towards Arabs in West Bank and Golan Heights's territories minimally affect consumers' buying decisions. Given previous research on the impact of emotional connection and empathy on consumer behaviour, it is reasonable to anticipate that these factors may influence consumer attitudes and intentions toward products from Ukraine, particularly given the challenging circumstances surrounding the war.

4 LEGISLATIVE IMPLICATIONS OF "MADE IN ..." LABELS

Using "Made in..." labels on products bears considerable legislative implications. Countries have established specific regulations and laws governing the requirements for labelling prod- ucts with their COO. These regulations aim to provide consumers with accurate information about the origin of products and prevent deceptive practices. Legislative concerns related to "Made in..." labels predominantly revolve around three key domains: COO determination, labelling requirements, and measures for ensuring compliance and enforcement.

Determining the COO can be complex, particularly when products are manufactured or assembled across multiple countries. Legislative frameworks often establish specific criteria and guidelines for COO determination, considering factors such as the location of substantial transformation, the value added in a particular country, or the source of critical components. For instance, in Ukraine, the Customs Code or guidance from the Chamber of Commerce and Industry30 can be consulted to determine the COO for goods. Although ‘goods of domestic production’ lacks a legal definition, it generally refers to goods manufactured within Ukraine. When products are manufactured in multiple countries, the COO is typically determined based on the criterion of sufficient processing. In other words, the country where the final manufacturing or processing operations occurred, imparting the goods with their essential characteristics, is considered the COO.

Legislations commonly specify particular requirements for product labelling that denote the COO. These requirements often encompass the size, visibility, and placement of the "Made in..." label on the product or its packaging. For instance, COO product labelling is considered voluntary in Ukraine. However, non-compliance with safety and quality indicators may result in fines for food products, impacting both legal entities and individual entrepreneurs. Dur- ing the early months of the war, some labelling requirements were simplified to ensure the ready availability of essential products in the market. However, the European Commission is currently working on introducing mandatory origin marking for all non-food products, including textiles. The specific timeline for implementation of this regulation, however, remains undecided by the EU Parliament.31

During times of war, businesses may encounter challenges in meeting product labelling requirements. Although government authorities may attempt to alleviate burdens for man- ufacturers and importers during such periods, businesses may still require further assistance. The situation is expected to continue to evolve, and authorities may take further actions in the short and medium term to address these challenges.32 In contrast, the European Community has implemented strict measures, including administrative and criminal penalties, for viola- tions of CE marking rules. Products that do not comply with EU directives and harmonised standards mandating the use of the CE Mark are prohibited from the EU internal market.

Using state symbols necessitates carefully considering the legislative regulations specific to each country. In Ukraine, state symbols are subject to governance by several legislative acts, including the Constitution of Ukraine,33 which specifies the official state symbols, and the Law of Ukraine on Advertising,34 which prohibits using or imitating state symbols that may promote disrespect towards them. The Draft Law of Ukraine on State Symbols35 also provides a comprehensive description and outlines the procedures for using and protecting state symbols.

In the European Union, "Made in..." labels must adhere to stringent standards set by the Paris Convention for the Protection of Industrial Property and the EU Community Trademark Regulation.36 These regulations explicitly prohibit the registration of signs containing national symbols without official consent from the relevant authority. The enforcement of "Made in..." labelling regulations is the responsibility of governments and regulatory bodies, which conduct inspections, verify labelling claims, and take necessary actions against violations.

It is important to note that while the Paris Convention provides a framework for safeguarding intellectual property, including trademarks and trade names, it does not directly address using national symbols for commercial purposes within the EU. This matter is generally addressed through national legislation and may also be influenced by guidelines or directives at the EU level. Specifically, the primary purpose of the Paris Convention's Article 6 is to protect armorial bearings, flags, and other State emblems of the States that are party to the Paris Convention, as well as official signs and hallmarks indicating control and warranty adopted by them.37 As a result, the use of national symbols for commercial purposes within the EU must strictly comply with these regulations to avoid any legal consequences.

5 EUROPEAN PHARMACEUTICAL LEGAL AND REGULATORY LANDSCAPE

The legal and regulatory framework governing pharmaceuticals in the European context38 exhibits a notably intricate structure featuring a network of regulatory authorities spanning 30 European Economic Area nations. This consortium encompasses the 27 EU Member States, Iceland, Liech- tenstein, and Norway. This unique regulatory system is underscored by a harmonious synergy among approximately 50 distinct regulatory bodies, underpinned by collaborative interactions among these entities, the European Commission, and the European Medicines Agency (EMA). This collaborative approach harnesses the substantial expertise contributed by more than 4,000 experts from diverse regions across Europe, thus enabling unrestricted access to top-tier scientific knowledge and expertise, ensuring the highest level of scientific guidance.

The EMA and the Member States collaborate extensively to evaluate new medicinal prod- ucts, ensure their safety, and address public health emergencies. This partnership involves the exchange of information across various regulatory domains, including the reporting of adverse drug reactions, the oversight of clinical trials, and the inspection of pharmaceutical manufacturers to ensure compliance with established standards of good clinical practice (GCP),39 good manufacturing practice (GMP),40 good distribution practice (GDP),41 and good pharmacovigilance practice (GVP).42 This cooperation is facilitated by EU legislation that mandates uniform rules and standards for authorising and overseeing medicines among Member States. These regulations effectively reduce duplication and enhance the efficiency of pharmaceutical regulation throughout the EU.

The legal framework governing veterinary and human medicines within the EU is primarily established through Regulations (EU) 2019/643 and (EC) 726/2004,44 along with Directive 2001/83/EC,45 which form the foundational basis for pharmaceutical law. Over time, these regulations have expanded to encompass specialised domains within the pharmaceutical sector, including pediatric, advanced therapy, orphan, and traditional herbal medicines. These sectors are subject to distinct legal frameworks and regulations tailored to address their specific characteristics and needs within the EU's pharmaceutical landscape.46

The European pharmaceutical regulatory framework is further underpinned by Directives 65/65/EEC,47 75/318/EEC,48 and 75/319/EEC,49 bolstered by 2004 EU regulations. A signifi- cant milestone in this framework is Directive 2011/62/EU,50 amending Directive 2001/83/EC, which is vital in enhancing safeguards against counterfeit medicines within the EU supply chain. This directive mandates authenticity labels on pharmaceutical packaging, stricter manufacturing inspections, mandatory reporting of suspicious counterfeit medicines, and the requirement for online pharmacy websites to display a specific logo linked to official na- tional registers. These measures fortify public health protection and uphold pharmaceutical market integrity in the EU.

Within the EU, medicines are classified into prescription and non-prescription, primarily based on their active ingredients. Some herbal and over-the-counter (OTC) medicines fall into the category that allows them to be sold outside of pharmacies, and certain products even permit self-service. However, it is crucial to emphasise that advertising prescription medicines to the general public is strictly prohibited. Conversely, OTC medicines, includ- ing those eligible for reimbursement, are subject to regulations permitting their promotion through various media channels.

A rigorous authorisation process is obligatory for all medicines before they can be marketed to ensure the availability of safe, effective, high-quality medicines for EU citizens and safeguard public health. The European regulatory system offers several routes for such authorisation, with the centralised marketing authorisation procedure being a prominent mechanism applicable to both human and veterinary medicines. This procedure operates under the framework of Regulations (EC) 726/2004 (as amended)51 and (EU) 2019/652.

The centralised procedure is designed to simplify bringing medicines to the market by facil- itating a single, EU-wide assessment and marketing authorisation that is legally valid across all EU Member States. Pharmaceutical companies are mandated to submit a single application for authorisation directly to the EMA. Subsequently, the Committee for Medicinal Products for Human Use or Committee for Veterinary Medicinal Products undertakes a comprehen- sive scientific evaluation of the application, ultimately furnishing a recommendation to the European Commission regarding the grant of marketing authorisation. Once granted by the European Commission, the centralised marketing authorisation automatically extends to cover all EU Member States.

The centralised marketing authorisation procedure is mandatory for most innovative medicines, including those featuring new active substances tailored for addressing critical conditions such as HIV/AIDS, cancer, diabetes, neurodegenerative disorders, autoimmune diseases, and specific viral infections. In addition, it covers medicines derived from biotechnology, advanced therapies like gene and cell therapy, tissue-engineered medicines, orphan drugs designed for rare diseases, and veterinary growth enhancers. However, the centralised procedure remains optional for other medicines, such as those with new active substances intended for indications beyond those previously mentioned, those demonstrating significant therapeutic, scientific, or technical advancements, and those serving broader public or animal health interests at the EU level.53

In the current regulatory landscape, the predominant route for evaluating and authorising new and pioneering medicines is the centralised authorisation procedure, which expedites their entry into the EU market. However, most generic and non-prescription medicines are evaluated and authorised nationally within the EU Member States. Furthermore, a substan- tial portion of older medicines currently available underwent initial authorisation through national-level procedures before establishing the EMA and harmonising regulatory processes at the EU level.

Each EU Member State maintains its distinct national authorisation processes for medicines. When pharmaceutical companies seek authorisation in multiple Member States, they can opt for two procedures. The Decentralised Procedure permits concurrent authorisation in several EU Member States for medicines outside the centralised procedure's scope that have not been previously authorised in any EU country. Conversely, the Mutual Recognition Procedure allows companies with existing authorisation in one EU Member State to seek recognition in others, facilitating the authorisation process by relying on shared scientific assessments.

For example, two primary regulatory authorities in Germany oversee pharmaceutical products: the Federal Institute for Drugs and Medical Devices and the Paul Ehrlich Institute.54 The first institution holds responsibility for a wide range of pharmaceuticals, including conventional medicines and medical devices. At the same time, the Paul Ehrlich Institute specialises in regulating advanced biotechnology products such as sera, vaccines, and genetically engineered medical components. Regardless of whether these pharmaceuticals are intended for the German market or export, both authorities subject them to rigorous assessments to ensure they meet stringent quality, safety, and efficacy standards before granting authorisation. This rigorous evaluation process underscores Germany's commitment to safeguarding public health and maintaining the integrity of its pharmaceutical sector.

Over the past years, Ukraine has made substantial progress in aligning its pharmaceutical legislative framework with EU laws, demonstrating its commitment to integrating with Euro- pean regulatory standards.55 This harmonisation effort encompasses various aspects, including establishing the State Service of Ukraine for Medicines and Drugs Control as the country's pharmaceutical regulatory authority, mirroring the EMA's role in the EU. Moreover, Ukraine has made strides in synchronising its GMP standards with EU requirements, thereby ensuring the quality and safety of locally manufactured pharmaceuticals. Additionally, the nation has introduced streamlined processes and criteria for the marketing authorisation of medicines, making them more compatible with EU regulations. These initiatives reflect Ukraine's dedi- cation to achieving regulatory alignment with the EU in the pharmaceutical sector.

6 RESEARCH METHODS

This research explores the opportunities and challenges Ukrainian products face, particularly in the pharmaceutical sector, as they seek to leverage the strengthened national brand resulting from the Russian full-scale invasion. The focus is primarily on the German market, chosen due to Ukraine's long-standing presence in the pharmaceutical industry, featuring established manufacturers and a proficient workforce.56 Ukraine has several competitive advantages, in- cluding cost-effectiveness, strong manufacturing capacities, and a diverse product portfolio. These factors enhance the attractiveness of Ukrainian pharmaceutical products to German buyers who prioritise high-quality offerings at competitive prices.

The growing interest in Ukraine provides a promising opportunity for increased support and investment, particularly in the post-war period. Such support could lead to improvements in infrastructure, regulatory reforms, and investments in the pharmaceutical sector, ultimately making Ukrainian pharmaceutical products more appealing in the German market. Fur- thermore, the geopolitical dynamics surrounding Ukraine and Germany's potential political motivations to bolster economic relations create avenues for Ukrainian pharmaceutical companies to enter the German market. The EU-Ukraine Association Agreement57 further facilitates trade and market access for Ukrainian pharmaceutical products in Germany and the broader European Union.

Moreover, Germany's extensive and advanced healthcare system generates substantial demand for pharmaceutical products, enabling Ukrainian manufacturers to access an established market. Germany's reputation for strict quality standards in healthcare benefits Ukrainian pharmaceutical companies capable of meeting these requirements and obtaining the necessary certifications. Despite the ongoing conflict in Ukraine introducing uncertainties, establishing a presence in the German market positions Ukrainian pharmaceutical companies for future growth and allows them to leverage opportunities as the situation stabilises. Additionally, Ukraine's geographical proximity to Germany offers logistical advantages, including shorter delivery times and lower shipping costs, further enhancing the attractiveness of Ukrainian products to German buyers.

Hence, the selection of the German market aligns perfectly with the research objective of exploring the opportunities and challenges for Ukrainian pharmaceutical products in the European Union. The well-developed industry, growing interest and support, geopolitical considerations, market potential, and the potential for future stability collectively justify the focus on the German market.

The research methodology adopts a two-stage approach to fulfil the research objective. In the initial stage, desk research examines the external environmental factors in the German pharmaceutical market, contributing to the opportunities or threats encountered by "Made in Ukraine" pharmaceuticals. Subsequently, the second stage encompasses a survey administered to German residents, aiming to explore their purchasing behaviour and attitudes towards Ukrainian medicine and the country as a whole.

The PESTEL analysis framework was applied to scrutinise the macro-environmental factors influencing Ukrainian pharmaceutical manufacturers in the German market. This methodical examination encompassed various categories of factors, spanning political, economic, social, legal, and other dimensions. A rigorous selection was undertaken to identify the most influ- ential factors affecting these companies.58 Each selected factor underwent an expert evaluation employing a 10-point rating scale. This scale stratified the factors into three discrete tiers of influence. Factors with a low impact were represented by scores within the [0.0 to 3.3] range. Those with a moderate impact received scores within the [3.4 to 6.6] range. Factors deemed to have a high impact were identified by scores ranging from [6.7 to 10.0].

Specific evaluation criteria were defined for each factor, serving as a structured framework for the assessment process. These criteria provided a clear roadmap for analysis, ensuring a systematic and comprehensive evaluation. Furthermore, weighting factors were introduced to quantify the relative significance of each factor. Unlike traditional percentage-based cal- culations, these weighting factors were expressed as fractions of one, offering a more precise measurement of each factor's impact on Ukrainian pharmaceutical companies' activities in the German market. Following the evaluation process, strategic approaches were formulated to leverage opportunities and address threats associated with each factor selected for analy- sis. These strategies encompassed proactive measures to harness favourable conditions and responsive actions to mitigate potential risks, culminating in a comprehensive approach to navigating the complex macro-environmental landscape of the German market.

The survey aimed to understand the current perception of Ukraine among German residents, specifically focusing on how this perception influences consumer motivations. Four research questions were formulated to guide the investigation into the motivations that shape the selection of pharmaceutical products:

RQ1: What underlying motivations drive Germans when choosing pharmaceutical products?

RQ2: To what extent are German residents familiar with Ukrainian pharmaceutical products and Ukraine as a country?

RQ3: Is there a correlation between the support shown towards Ukraine during times of war and the attitudes of Germans towards Ukrainian medicine?

RQ4: What are the Germans' primary associations with Ukraine as a nation?

The survey was conducted from March to May 2022, coinciding with the early stages of Rus- sia's full-scale invasion of Ukraine. An online self-administered questionnaire was employed to gather data, which collected responses from a random sample comprising 78 individuals. The sample was characterised by a predominant representation of socially and economically active individuals, with a noteworthy proportion of female respondents (65%) and a signif- icant majority holding EU citizenship (85%). Moreover, a significant % of the sample (84%) indicated employment or self-employment, covering various professions, including office workers, business owners, and freelancers. It is worth mentioning that approximately half of the survey participants were currently pursuing higher education at the university level.

The survey sample's gender distribution, with a slightly higher percentage of females, may not perfectly align with the overall gender distribution of the German population, which is roughly equal in terms of males and females. However, this minor discrepancy should not significantly impact the overall findings and insights drawn from the survey data. Regarding employment status, the substantial representation of employed or self-employed individuals in the sample suggests that it reflects the broader population's workforce participation rates and economic activity. This alignment with the employment status of the general population enhances the survey's relevance and applicability to understanding consumer behaviour in Germany. The presence of a significant portion of respondents engaged in higher education at the university level is consistent with Germany's robust education system and the preva- lence of individuals pursuing tertiary qualifications. This sample characteristic underscores its suitability for exploring consumer attitudes and motivations among a well-educated population segment.

In summary, while the sample may not perfectly mirror the demographic distribution of the entire German population, it generally aligns with expectations based on knowledge of Ger- man demographics. The sample's characteristics reflect the socio-economic activity, gender representation, and educational aspirations observed in the broader German population, making it suitable for the study's objectives.

7 FACTORS AFFECTING "MADE IN UKRAINE" PHARMACEUTICALS IN THE GERMAN MARKET: DESK RESEARCH ANALYSIS

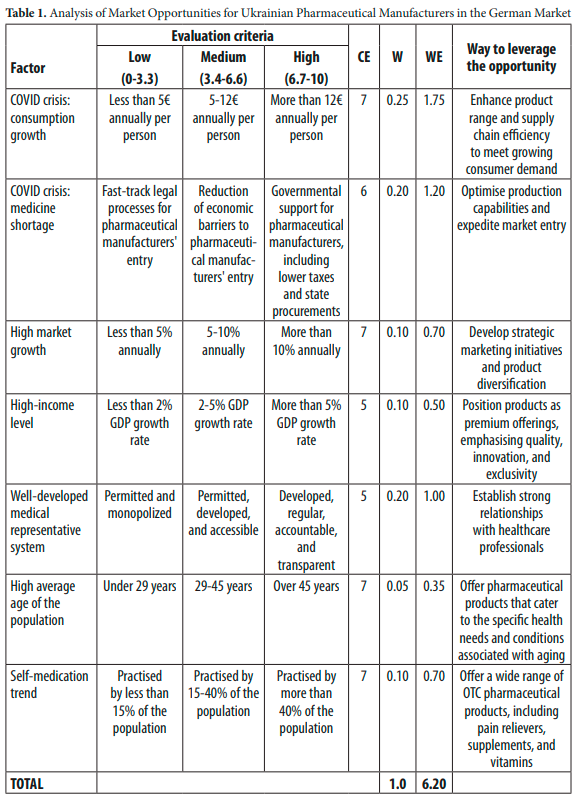

The desk research indicates that the German market offers more opportunities than threats for Ukrainian pharmaceutical companies. Political factors suggest that the German government's support during medicine shortages resulting from the pandemic reduces economic barriers and expedites the introduction of generic pharmaceuticals, creating an opportunity. Further-more, Germany's relatively low level of corruption, ranked 17th worldwide in transparency, provides a less hostile environment for Ukrainian companies seeking to enter the market. From an economic perspective, Germany's high income level signifies an opportunity since countries with higher incomes tend to prioritise scientifically-based medicine and exhibit higher consumption rates. However, the significant growth rate of the European pharma- ceutical market poses a mild threat due to intensified competition. On a positive note, the COVID-19 crisis has stimulated increased demand for pharmaceutical products, presenting an opportunity for Ukrainian companies to meet this rising need.

Regarding social factors, the similarity between the EU's and Ukrainian medical representative systems allows Ukrainian pharmaceutical companies to navigate the German market relatively easily due to an open, accessible, and lightly regulated system. Germany's ageing population also creates an opportunity as there is a greater demand for specific medications such as cardiovascular medicine, pain relievers, muscle pain management drugs, supplements, and vitamins. The prevailing trend of self-medication in Europe further enhances the opportunity, as many Europeans rely on medication instructions to address minor ailments. Furthermore, the role of pharmacist recommendations in customer decision-making presents an avenue for successful market entry by fostering strong business relationships with pharmacies.

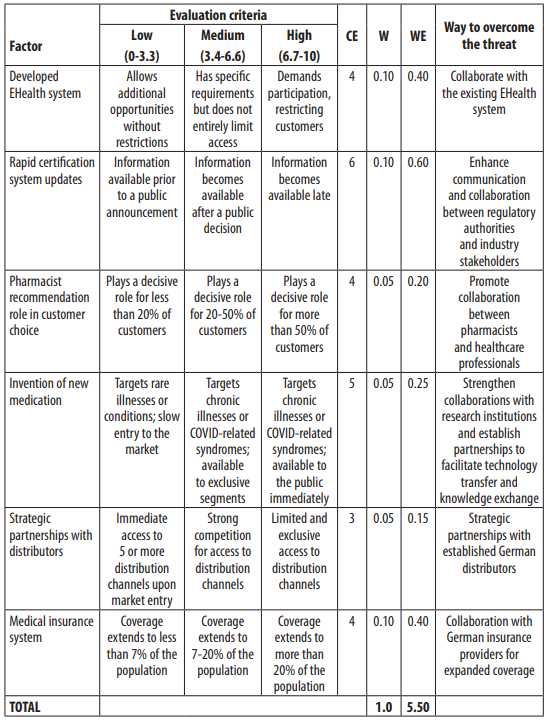

From a technological standpoint, Germany's well-developed EHealth system does not cur- rently pose a significant threat, given its participation in authorised pharmaceutical producers. However, the emergence of new medications, particularly for chronic illnesses, may pose a low threat once they become available to the broader population. Regarding legal considerations, the rapid updates to the certification system in Germany present a mild threat, as pharma- ceutical companies must stay abreast of changing laws and regulations to ensure compliance. Furthermore, the dominance of major pharmaceutical companies controlling a substantial portion of the European market may present challenges in accessing distribution channels and intermediaries. Additionally, the growth rate of prescription-only medicines (POM) poses a mild threat, as Ukrainian pharmaceutical companies must navigate the bureaucratic process to become part of the POM system.

Table 1 summarises market opportunities for Ukrainian pharmaceutical manufacturers in the German market. Each factor is assessed based on specific criteria with an assigned evaluation score (CE) and weight (W). The weighted evaluation (WE) is obtained by multiplying the CE with the assigned weight. The total weighted evaluation reflects the overall potential for market opportunities, which in this case is 6.20.59

Notes: CE denotes the current evaluation of the factor, W represents the assigned weight, WE represents the weighted evaluation, and the ‘Way to Leverage the Opportunity’ column suggests strategies to capitalise on the identified opportunities.

The analysis underscores several advantageous opportunities for Ukrainian pharmaceuti- cal manufacturers in the German market. These opportunities encompass leveraging the COVID crisis for consumption growth, addressing medicine shortages, capitalising on high market growth, targeting a high-income level demographic, utilising a well-developed medi- cal representative system, tapping into the self-medication trend, and catering to the needs of an ageing population. To capitalise on these opportunities, Ukrainian companies should enhance their product portfolio and improve supply chain efficiency, optimise their produc- tion capabilities, develop strategic marketing initiatives, position their products as premium offerings, establish strong relationships with healthcare professionals, offer specialised products for the ageing population, and provide a wide range of OTC pharmaceuticals. The overall weighted evaluation of 6.20 indicates significant market potential and growth opportunities.

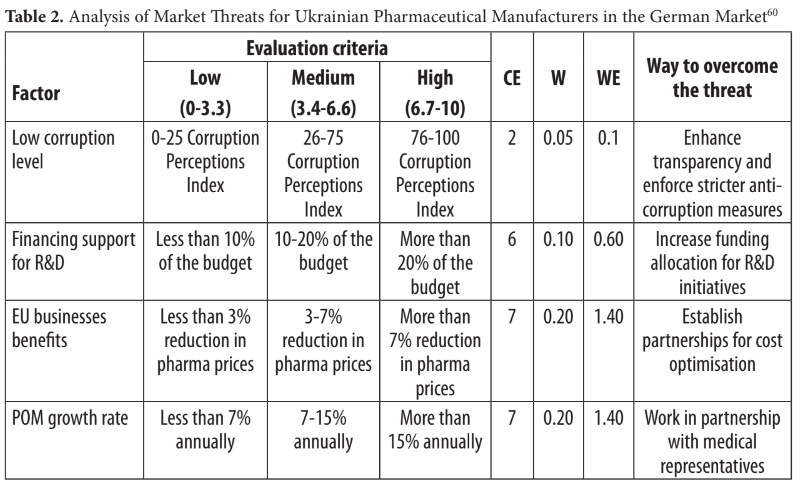

On the other hand, Table 2 examines the threats confronting Ukrainian pharmaceutical manufacturers in the German market. These threats encompass a low corruption level, limited R&D financing, modest benefits for EU businesses, POM's high growth rate, rapid certification requirements updates, the influence of pharmacist recommendations on cus- tomer choice, and the availability of new medications. To mitigate these threats, Ukrainian companies should prioritise enhancing transparency and anti-corruption measures, increas- ing R&D funding, optimising costs through partnerships, closely collaborating with medical representatives, integrating with the existing EHealth system, improving communication and cooperation with regulatory authorities and industry stakeholders, promoting collaboration between pharmacists and healthcare professionals, strengthening ties with research institu- tions, establishing strategic partnerships with distributors, and collaborating with German insurance providers for broader coverage. Despite threats, the weighted evaluation of 5.50 indicates that the German pharmaceutical market offers more opportunities than challenges for Ukrainian manufacturers.

Notes: CE denotes the current evaluation of the factor, W represents the assigned weight, WE represents the weighted evaluation, and the ‘Way to Overcome the Threat’ column suggests strategies to address the identified threats.

8 GERMAN ATTITUDES AND PURCHASING BEHAVIOUR TOWARD UKRAINIAN MEDICINE AND THE COUNTRY: SURVEY ANALYSIS

The survey results offer insights into the motivations that guide Germans in selecting phar- maceutical products. The analysis of responses and statistical techniques identified key factors influencing the decision-making process. Understanding consumer behaviour within the pharmaceutical market empowers companies to align their offerings with consumer prefer- ences and efficiently meet the needs of the German population.

RQ1: What underlying motivations drive Germans when choosing pharmaceutical products?

The survey results revealed that many participants reported regular consumption of medicine for chronic diseases (53.85%), with a majority indicating regular intake of vitamins and sup- plements (62.82%). The 95% confidence intervals for these proportions suggest that the actual percentages of individuals engaging in these practices likely fall within 41.60% to 66.00% for medicine consumption and 51.32% to 72.76% for vitamins and supplements. Acknowledging the potential variation in individual interpretations of the term ‘regularly’ is essential, as this term was not explicitly defined in the questionnaire.

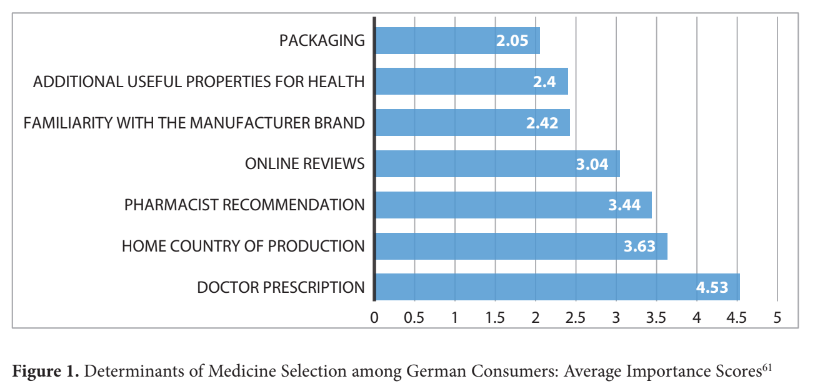

The survey also shed light on the decision-making patterns when individuals experience illness or notice body changes. A significant portion of respondents (37.18%) preferred visiting a pharmacy and consulting with a pharmacist, while a notable percentage (17.95%) relied on online recommendations. A smaller proportion (2.56%) sought advice from family members, while the majority (42.31%) opted to visit a doctor and follow their prescribed treatments. These findings correspond to the significance of various factors in selecting medicine, vitamins, and supplements.

The importance of a doctor's prescription received the highest median rating of 5, indicating its paramount significance in respondents' decision-making process. Familiarity with the manufacturer brand, pharmacist recommendation, and the home country of production received median ratings of 3 and 4, underscoring their considerable influence. Online reviews and additional health properties garnered a median of 3, suggesting moderate importance. In contrast, packaging obtained a lower median rating of 2, implying a lesser impact on decision-making (see Fig. 1).

The survey findings indicated that a significant proportion of consumers (43.59%) adhere to doctors' prescriptions in the context of generics. Some consider generic alternatives influ- enced by pharmacist consultations (21.79%) or price considerations (16.67%). These results underscore the diverse attitudes and considerations when choosing generic medicine. For pharmaceutical companies aiming to navigate the complex landscape of consumer preferences and decision-making processes, it is essential to establish strong relationships with medical professionals and pharmacists. This will enable them to understand better and cater to their target audience's needs and considerations.

RQ2: To what extent are German residents familiar with Ukrainian pharmaceutical products and Ukraine as a country?

The survey results confirm the expected outcome that most participants had not experienced Ukrainian products. Using the Wilson score interval formula, the estimated proportion of respondents who have not tried any Ukrainian-made products falls within the range of 64.18% to 77.01% with a 95% confidence level. However, it is noteworthy that a significant portion of respondents expressed uncertainty about the origin of the products they consume, indicat- ing a lack of awareness. Only 9% of respondents claimed familiarity with Ukrainian goods in at least one category. Food items and online services such as Grammarly were frequently cited among the products mentioned by participants. These findings emphasise the necessity for heightened efforts in raising awareness and promoting Ukrainian products to appeal to a broader consumer base. Enhancing visibility and educating consumers about the quality and advantages of Ukrainian goods are crucial steps toward fostering market acceptance and expanding their reach.

RQ3: Is there a correlation between the support shown towards Ukraine during times of war and the attitudes of Germans towards Ukrainian medicine?

The survey results indicate a high willingness among respondents to support Ukraine by purchasing its pharmaceutical products. Specifically, 47.44% of respondents expressed their readiness to buy these products if prescribed by their doctors, while 38.46% would do so based on pharmacist recommendations. Additionally, 10.26% of respondents would support Ukraine by purchasing its vitamins and supplements. In contrast, only a small proportion of respondents (5.13%) stated they would not support Ukraine in this manner.

Confidence intervals were calculated using the Wilson score interval method at a 95% confidence level to provide a reliable estimate of the proportions. The confidence intervals for the ‘Yes’ responses indicate that the true proportion of respondents willing to support Ukraine falls between 94.34% and 99.35%. Conversely, the confidence interval for the ‘No’ responses suggests that the proportion of respondents unwilling to support Ukraine ranges from 0.65% to 5.66%.

These findings demonstrate a strong inclination among most Germans to support Ukraine by purchasing its pharmaceutical products. The results emphasise the significance of doctors' and pharmacists' opinions and recommendations in shaping consumer behaviour. Effective communication between healthcare professionals and patients is crucial in guiding medica- tion choices and fostering support for products from Ukraine.

RQ4: What are the Germans' primary associations with Ukraine as a nation?

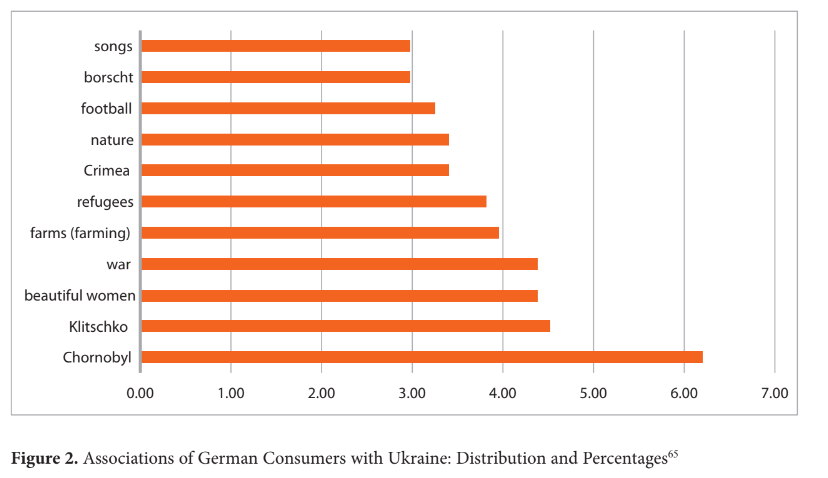

The survey findings reveal that the predominant associations of Germans with Ukraine include the Chornobyl tragedy (53.00%), Eurovision (42.00%), and personal acquaintance with Ukrainians (31.00%). These statistics validate that, for many EU residents, their initial exposure to Ukraine was through the significant and wide-reaching impact of the Chornobyl incident. It suggests that their understanding of the country surpasses surface-level familiarity.

The substantial contribution of Ukrainians to shaping the knowledge and the image of Ukraine implies that every citizen, to some extent, serves as a cultural diplomat or representative of his or her country. The responses further support the idea that the perception of Ukraine as a ‘singing nation’ is not solely a government-driven domestic agenda but has effectively shaped the perception of external consumers. This indicates that cultural diplomacy can be integrated into a public relations strategy as it already carries an associative framework. Consequently, Ukraine was not an abrupt and unfamiliar entity for EU residents solely due to the full-scale Russian invasion but a country they had been acquainted with long before.

The open-ended questionnaire deepened the previous association analysis by inviting re- spondents to provide their spontaneous associations evoked by the word ‘Ukraine.’ A total of 711 associations were documented, demonstrating a positive response as respondents exceeded the minimum requirement of five associations (see Fig. 2). Given that the survey was conducted in Germany, a notable percentage of associations (4.50%) revolved around the Klitschko brothers – well-known Ukrainian heavyweight boxing champions who built their careers in Germany.62

In line with previous findings, the historical event of Chornobyl strongly influences per- ceptions of Ukraine. While this incident had already garnered global recognition due to its profound impact, the release of the HBO mini-series in 201963 further heightened awareness of the tragedy. Associations related to Chornobyl were mentioned at a frequency exceeding 5.00%. It is reasonable to expect these associations to become more pronounced in light of the Russian occupation of the Chornobyl and Zaporizhzhia nuclear power plants at the be- ginning of the full-scale invasion, coupled with the ongoing threats of potential sabotage.64 These developments entail global risks of new radiation contamination, which could further cement Chornobyl's significance in public perception and awareness.

The stereotype of Ukrainian women's beauty is a recurring theme (4.36%), encompassing both positive and negative connotations. The negative aspect of this association underscores a shallow focus on appearance without a deeper appreciation of Ukrainian nature and culture. This narrow assessment based solely on physical attractiveness may stem from stereotypes associated with sex tourism. Conversely, the positive interpretation suggests associating Ukraine with beauty reflects a favourable attitude toward the nation.

The presence of associations related to ‘war’, ‘refugees,’ and ‘Crimea’ does not inherently de- note a positive or negative attitude. However, their prominence suggests that respondents are well-informed about current events, including the tragic days of 2014. Associations related to farming and nature indicate a prevailing perception of Ukraine as an agricultural country. Although the agricultural and pharmaceutical sectors are distinct, the link between homoe- opathy and natural resources can be used to construct a narrative based on these associations.

The final three associations foster an awareness of Ukraine's cultural life, encompassing its achievements, cuisine, and creativity. These associations fall within the entertainment category and offer insights into the perception of a typical Ukrainian as athletic, musically inclined, and adhering to a healthy diet. This image portrays a relatively healthy individual without specific expertise.

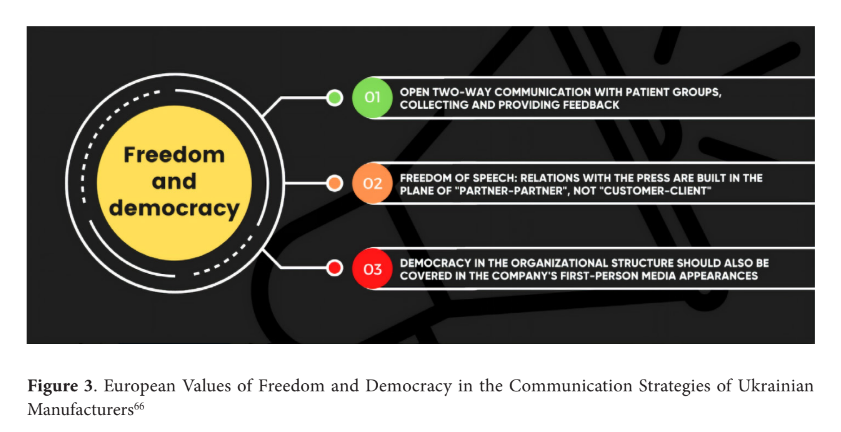

The survey results indicate that European consumers have a limited and somewhat narrow perception of Ukrainian products, mainly associating Ukraine with agricultural goods. However, their overall perception of Ukraine tends to be neutral, which creates an opportunity to shape new stereotypes and associations. Notably, the ongoing war and Ukraine's struggle against Rus- sian aggression have made freedom a significant value associated with the country. Although the concept of freedom may initially appear contradictory to quality assurance principles in production and health, it can be reframed as the absence of restrictions and limitations imposed by diseases and illnesses. Highlighting how pharmaceutical products promote a healthy state of the body and provide individuals with freedom from health-related constraints could be a compelling message for Ukrainian manufacturers in their communication strategies. By com- municating these values, Ukrainian companies could enhance their positioning in the German market, emphasising their commitment to ethical practices, patient-centric communication, and transparent operations (Fig. 3). It allows them to align with their target audience's values and showcase their products' positive impact on individuals' well-being and quality of life.

9 CONCLUSION

This article delves into the connection between the positive perception of Ukraine resulting from global support during the full-scale Russian invasion, the promotion of Ukrainian brands through the "Made in Ukraine" concept, and the consumption of national products. The desk research analysis and survey findings provide a deeper understanding of the opportunities and challenges Ukrainian pharmaceutical manufacturers face in the German market. This research provides practical implications for Ukrainian brands seeking to leverage Ukraine's favourable international perception.

The COO effect is pivotal in shaping consumer perceptions and purchase decisions. Factors such as reputation, historical associations, and cultural stereotypes influence these percep- tions, impacting preferences for domestic or foreign products. While ethnocentrism often drives the home country bias, consumers may also embrace foreign brands aligned with their values. Notably, limited research explores the influence of war and adverse circumstances on consumer behaviour, presenting an area for future investigation.

Using "Made in..." labels involves legislative complexities related to COO determination, labelling requirements, and compliance enforcement. Pharmaceutical regulation is a complex European network prioritising safety and counterfeit prevention, focusing on uniform rules and efficiency. Germany, as a key EU Member State, maintains rigorous pharmaceutical oversight. Ukraine's commitment to aligning its pharmaceutical regulations with EU stand- ards demonstrates its dedication to regulatory convergence. This aligns with broader efforts to integrate with European regulatory norms, positioning Ukraine as a potential player in the European pharmaceutical sector. Understanding the COO effect and navigating related legislative aspects are vital for businesses seeking international success in today's competi- tive global market.

The desk research analysis identified several market opportunities for Ukrainian pharma- ceutical manufacturers in the German market. These opportunities include leveraging the COVID-19 crisis to stimulate consumption growth, addressing medicine shortages, capitalising on the high growth potential of the market, targeting high-income demographics, utilising a well-established medical representative system, tapping into the self-medication trend, and catering to the needs of an ageing population. While certain threats were also identified, such as POM's high growth rate and rapid updates in certification requirements, the overall evaluation suggests that the German pharmaceutical market presents more opportunities than challenges for Ukrainian manufacturers.

The survey analysis explored the motivations and attitudes of Germans toward Ukrainian pharmaceutical products. It revealed that many Germans regularly consume medicine for chronic diseases and rely on vitamins and supplements. The survey also emphasised the im- portance of doctors' prescriptions and pharmacists' recommendations in decision-making. Although most respondents were unfamiliar with Ukrainian pharmaceutical products, there is potential to increase awareness and promote them among the German population. Notably, the survey demonstrated a strong willingness among Germans to support Ukraine by purchasing its pharmaceuticals, indicating a positive association between the support shown towards Ukraine during times of war and the attitudes of Germans towards Ukrain- ian medicine. Germans primarily associate Ukraine with the Chornobyl tragedy, Eurovision, acquaintances with Ukrainians, and perceptions of Ukrainian women's beauty.

Based on these findings, Ukrainian pharmaceutical manufacturers can leverage the positive perception of Ukraine in the German market through effective communication strategies. By emphasising core values of freedom, democracy, and ethical practices, companies could resonate with German consumers and set Ukrainian brands apart from competitors. Es-tablishing strong relationships with healthcare professionals and recognising the influential role of pharmacists in customer decision-making could also contribute to successful market entry. Additionally, Ukrainian companies could capitalise on existing associations related to cultural achievements and natural resources to shape a multidimensional and positive image of Ukraine in the eyes of German consumers.

Looking ahead, Ukrainian pharmaceutical manufacturers should focus on enhancing their product range and supply chain efficiency, optimising production capabilities, developing strategic marketing initiatives, and cultivating strong relationships with healthcare profes- sionals. Offering specialised products for the ageing population and providing a wide range of OTC pharmaceuticals are essential steps. Continuous efforts to raise awareness and promote Ukrainian products in the German market are vital, focusing on highlighting quality, efficacy, and ethical practices. Collaborating closely with regulatory authorities, industry stakeholders, research institutions, and distributors will be crucial in navigating the German market and accessing distribution channels.

While this study specifically focused on the German market, the insights gained are also relevant to other international markets. The findings from this study contribute to under- standing the country's image, national branding, and consumer preferences, providing a foundation for Ukrainian brands to expand their presence and effectively compete globally.

1Brand Ukraine and Ministry of Foreign Affairs of Ukraine, ‘Ukraine's Global Perception Report, 2022’ (Brand Ukraine, 31 January 2023) https://brandukraine.org.ua/en/analytics/zvit-pro-sprijnyattya- ukrayini-u-sviti-2022/ accessed 11 July 2023.

2‘Impact of Russia-Ukraine war on Nation Brands’ [2022] Bloom Consulting Journal https://www.bloom- consulting.com/journal/impact-of-russia-ukraine-war-on-nation-brands accessed 11 July 2023.

3‘Import and Export of Ukraine: Influence of war’ (You Control, 21 December 2022) https://youcontrol. com.ua/data-research/import-ta-eksport-ukrayiny/ accessed 11 July 2023. accessed 26 August 2023.

4Gary M Erickson, Johny Johansson and Paul Chao, ‘Image Variables in Multi-Attribute Product Evaluations: Country-of-Origin Effects’ (1984) 11(2) Journal of Consumer Research 694, doi:10.1086/209005; Israel D Nebenzahl and Eugene D Jaffe, ‘Measuring the Joint Effect of Brand and Country Image in Consumer Evaluation of Global Products’ (1996) 13(4) International Marketing Review 5, doi:10.1108/02651339610127220; Mrugank V Thakor and Chiranjeev S Kohli, ‘Brand Origin: Conceptualization and Review’ (1996) 13(3) Journal of Consumer Marketing 27, doi:10.1108/07363769610147929; George Balabanis and Adamantios Diamantopoulos, ‘Domestic Country Bias, Country-of-Origin Effects, and Consumer Ethnocentrism: A Multidimensional Unfolding Approach’ (2004) 32(1) Journal of the Academy of Marketing Science 80, doi:10.1177/0092070303257644; Julie M Pharr, ‘Synthesizing Country-of-Origin Research from the Last Decade: Is the Concept Still Salient in an Era of Global Brands?’ (2005) 13(4) Journal of Marketing Theory and Practice 34, doi:10.1080/1 0696679.2005.11658557; Thomas Aichner, ‘Country-of-Origin Marketing: A List of Typical Strategies with Examples’ (2014) 21(1) Journal of Brand Management 81, doi:10.1057/bm.2013.24; Jonas Polfuß, ‘“Made in China” and Chinese Brand Management Across Cultures: A New Matrix Approach’ (2021) 33(1) Journal of International Consumer Marketing 19, doi:10.1080/08961530.2020.1731900.

5Eva Kipnis and others, ‘“They don't want us to become Them”: Brand Local Integration and Consumer Ethnocentrism’ (2012) 28(7-8) Journal of Marketing Management 836, doi:10.1080/0267257X.2012.698634.

6Peeter WJ Verlegh and Jan-Benedict EM Steenkamp, ‘A Review and Meta-Analysis of Country-of-Origin Research’ (1999) 20(5) Journal of Economic Psychology 521, doi:10.1016/S0167-4870(99)00023-9.

7Patricia Huddleston, Linda K Good and Leslie Stoel, ‘Consumer Ethnocentrism, Product Necessity and Polish Consumers' Perceptions of Quality’ (2001) 29(5) International Journal of Retail and Distribution Management 236, doi:10.1108/09590550110390896; Zafar U Ahmed and others, ‘Does Country of Origin Matter for Low-Involvement Products?’ (2004) 21(1) International Marketing Review 102, doi:10.1108/02651330410522925; Balabanis and Diamantopoulos (n 4); Luis-Alberto Casado-Aranda, Angelika Dimoka and Juan Sánchez-Fernández, ‘Looking at the Brain: Neural Effects of “Made in” Labeling on Product Value and Choice’ (2021) 60(2) Journal of Retailing and Consumer Services 102452, doi:10.1016/j.jretconser.2021.102452.

8Yohan Bernard and others, ‘Products Labeled as “Made in Domestic Country”: The Brand Matters’ (2020) 54(12) European Journal of Marketing 2965, doi:10.1108/EJM-04-2018-0229; Anqi Yu, Shubin Yu and Huaming Liu, ‘How a “China-Made” Label Influences Chinese Youth's Product Evaluation: The Priming Effect of Patriotic and Nationalistic News’ (2022) 66(C) Journal of Retailing and Consumer Services 102899, doi:10.1016/j.jretconser.2021.102899.

9Sita Mishra and others, ‘Investigating the Impact of Consumers' Patriotism and Ethnocentrism on Purchase Intention: Moderating Role of Consumer Guilt and Animosity’ (2023) 32(4) International Business Review 102076, doi:10.1016/j.ibusrev.2022.102076.

10Melissa S Burnett and Dale A Lunsford, ‘Conceptualizing Guilt in the Consumer Decision‐Making Process’ (1994) 11(3) Journal of Consumer Marketing 33, doi:10.1108/07363769410065454; Wuqiu Fan, Hanchun Zhong and Anding Zhu, ‘Destigmatising the Stigma: Understanding the Impact of Message Framing on Chinese Consumers' Guilt and Attitude Associated with Overspending Behaviour’ (2021) 20(1) Journal of Consumer Behaviour 7, doi:10.1002/cb.1848.

11Balabanis and Diamantopoulos (n 4); Terence A Shimp and Subhash Sharma, ‘Consumer ethnocentrism: Construction and validation of the CETSCALE’ (1987) 24(3) Journal of Marketing Research 280, doi:10.2307/3151638.

12Mishra and others (n 9).

13C Min Han, ‘The Role of Consumer Patriotism in the Choice of Domestic Versus Foreign Products’ (1988) 28(1) Journal of Advertising Research 25; Mishra and others (n 9).

14Sergio W Carvalho, David Luna and Emily Goldsmith, ‘The Role of National Identity in Consumption: An Integrative Framework’ (2019) 103 Journal of Business Research 310, doi:10.1016/j.jbusres.2019.01.056.

15Polfuß (n 4).

16Ngoc Ha Nguyen and others, ‘Role of Consumer Ethnocentrism on purchase Intention Toward Foreign Products: Evidence from data of Vietnamese Consumers with Chinese Products’ (2023) 9(2) Heliyon e13069, doi:10.1016/j.heliyon.2023.e13069.

17Kipnis and others (n 5).

18Pharr (n 4).

19George Balabanis and Carmen Lopez, ‘Reflective Versus Unreflective Country Images: How Ruminating on Reasons for Buying a Country's Products Alters Country Image’ (2022) 31(5) International Business Review 102024, doi:10.1016/j.ibusrev.2022.102024.

20WK Li and KB Monroe, ‘The Role of Country of Origin Information on Buyers’ Product Evaluation: An In-Depth Interview Approach’ in Ama Educators' Proceedings: Enhancing Knowledge Development in Marketing, vol 3 (Amer Marketing Assn 1992) 274.

21Aichner (n 4).

22Amro A Maher and Larry L Carter, ‘The Affective and Cognitive Components of Country Image: Perceptions of American Products in Kuwait’ (2011) 28 (6) International Marketing Review 559, doi:10.1108/02651331111181411.

23Camilla Barbarossa, Patrick De Pelsmacker and Ingrid Moons, ‘Effects of Country-of-Origin Stereotypes on Consumer Responses to Product-Harm Crises’ (2018) 35(3) International Marketing Review 362, doi:10.1108/IMR-06-2016-0122.

24Adamantios Diamantopoulos and others, ‘The Bond Between Country and Brand Stereotypes: Insights on the Role of Brand Typicality and Utilitarian/Hedonic Nature in Enhancing Stereotype Content Transfer’ (2021) 38(6) International Marketing Review 1143, doi:10.1108/IMR-09-2020-0209.

25Maher and Carter (n 22).

26Peter Magnusson, Stanford A Westjohn and Nancy J Sirianni, ‘Beyond Country Image Favorability: How Brand Positioning Via Country Personality Stereotypes Enhances Brand Evaluations’ (2019) 50(3) Journal of International Business Studies 318, doi:10.1057/s41267-018-0175-3.

27Terence Motsi and Ji Eun Park, ‘National Stereotypes as Antecedents of Country-of-Origin Image: The Role of the Stereotype Content Model’ (2020) 32(2) Journal of International Consumer Marketing 115, doi:10.1080/08961530.2019.1653241.

28Jill Gabrielle Klein, Richard Ettenson and Marlene D Morris, ‘The Animosity Model of Foreign Product Purchase: An Empirical Test in the People's Republic of China’ (1998) 62(1) Journal of Marketing 89, doi:10.2307/1251805.

29Hayiel Hino, ‘More than Just Empathy: The Influence of Moral Emotions on Boycott Participation Regarding Products Sourced from Politically Contentious Regions’ (2023) 32(1) International Business Review 102034, doi:10.1016/j.ibusrev.2022.102034.

30Customs Code of Ukraine no 4495-VI of 13 March 2012 [2012] Official Gazette of Ukraine 32/1175 https://zakon.rada.gov.ua/laws/show/4495-17#Text accessed 11 July 2023.

31‘Product Labeling in Accordance with EU Requirements’ (Diia. Business Export, 2023) https://export. gov.ua/206-markuvannia_produktsii_vidpovidno_do_vimog_ies accessed 11 July 2023.

32Myroslava Koval-Lavok, ‘Features of Product Labeling in Ukraine During the Period of Martial Law’ Ekonomichna Pravda (Kyiv, 18 August 2022) https://www.epravda.com.ua/columns/2022/08/18/690574 accessed 11 July 2023.

33Constitution of Ukraine no 254 k/96-BP of 28 June 1996 (as amended of 01 January 2020) https:// zakon.rada.gov.ua/laws/show/254к/96-вр#Text accessed 11 July 2023.

34Law of Ukraine no 270/96-ВР ‘On Advertising’ of 3 July 1996 [1996] Vidomosti of the Verkhovna Rada of Ukraine 30/141 https://zakon.rada.gov.ua/laws/show/270/96-вр#Text accessed 11 July 2023.

35Draf Law of Ukraine no 4103-1 ‘On State Symbols of Ukraine, the Procedure for their Use and Protection’ of 03 March 2016 http://w1.c1.rada.gov.ua/pls/zweb2/webproc4_1?pf3511=58320 accessed 11 July 2023.

36Paris Convention for the Protection of Industrial Property (1883) https://www.wipo.int/treaties/en/ip/ paris/ accessed 11 July 2023; ‘European Union Trade Mark Legal Texts’ (European Union Intellectual Property Office (EUIPO), 2023) https://euipo.europa.eu/ohimportal/en/eu-trade-mark-legal-texts accessed 11 July 2023.

37‘General Information on Article 6ter’ (WIPO, 2009) https://www.wipo.int/article6ter/en/general_info. html accessed 27 July 2023.

38‘Legal Framework’ (European Medicines Agency, 2023) https://www.ema.europa.eu/en/about-us/what- we-do/legal-framework accessed 12 July 2023; European Medicines Agency, The European Regulatory System for Medicines: Bringing New Safe and Effective Medicines to Patients Across the European Union (EMA 2023) https://www.ema.europa.eu/en/about-us/how-we-work/european-medicines-regulatory- network accessed 12 July 2023.

39‘Good Clinical Practice’ (European Medicines Agency, 2023) https://www.ema.europa.eu/en/human- regulatory/research-development/compliance/good-clinical-practice accessed 12 July 2023.

40‘Good Manufacturing Practice’ (European Medicines Agency, 2023) https://www.ema.europa.eu/en/ human-regulatory/research-development/compliance/good-manufacturing-practice accessed 12 July 2023.

41‘Good Distribution Practice’ (European Medicines Agency, 2023) https://www.ema.europa.eu/en/ human-regulatory/post-authorisation/compliance/good-distribution-practice accessed 12 July 2023.

42‘Good Pharmacovigilance Practices’ (European Medicines Agency, 2023) https://www.ema.europa. eu/en/human-regulatory/post-authorisation/pharmacovigilance/good-pharmacovigilance-practices accessed 12 July 2023.

43Regulation (EU) 2019/6 of the European Parliament and of the Council ‘On Veterinary Medicinal Products and Repealing Directive 2001/82/EC (Text with EEA relevance)’ of 11 December 2018 https:// eur-lex.europa.eu/eli/reg/2019/6/oj accessed 11 July 2023.

44Regulation (EC) no 726/2004 of the European Parliament and of the Council ‘Laying Down Community Procedures for the Authorisation and Supervision of Medicinal Products for Human and Veterinary Use and Establishing a European Medicines Agency (Text with EEA relevance)’ of 31 March 2004 http:// data.europa.eu/eli/reg/2004/726/oj accessed 11 July 2023.

45Directive 2001/83/EC of the European Parliament and of the Council ‘On the Community Code Relating to Medicinal Products for Human Use’ of 6 November 2001 http://data.europa.eu/eli/dir/2001/83/oj accessed 11 July 2023.

46‘Legal Framework’ (n 38).

47Council Directive 65/65/EEC ‘On the Approximation of Provisions Laid Down by Law, Regulation or Administrative Action Relating to Proprietary Medicinal Products’ of 26 January 1965 (Date of end of validity 17/12/2001) http://data.europa.eu/eli/dir/1965/65/oj accessed 11 July 2023.

48Council Directive 75/318/EEC ‘On the Approximation of the Laws of Member States Relating to Analytical, Pharmaco-Toxicological and Clinical Standards and Protocols in Respect of the Testing of Proprietary Medicinal Products’ of 20 May 1975 (Date of end of validity 17/12/2001) http://data.europa.eu/eli/ dir/1975/318/oj accessed 11 July 2023.

49Second Council Directive 75/319/EEC ‘On the Approximation of Provisions Laid Down by Law, Regulation or Administrative Action Relating to Proprietary Medicinal Products’ of 20 May 1975 (Date of end of validity 17/12/2001) http://data.europa.eu/eli/dir/1975/319/oj accessed 11 July 2023.

50Directive 2011/62/EU of the European Parliament and of the Council ‘Amending Directive 2001/83/EC On the Community Code Relating to Medicinal Products for Human Use, as Regards the Prevention of the Entry into the Legal Supply Chain of Falsified Medicinal Products (Text with EEA relevance)’ of 8 June 2011 http://data.europa.eu/eli/dir/2011/62/oj accessed 11 July 2023.

51Regulation (EC) no 726/2004 (n 44).

52Regulation (EU) 2019/6 (n 43).

53‘Authorisation of Medicines’ (European Medicines Agency, 2023) https://www.ema.europa.eu/en/about- us/what-we-do/authorisation-medicines accessed 12 July 2023.

54Pharmaceuticals Export Promotion Council of India, ‘Regulatory and Market Profile of Germany’ (Pharmexcil, 2018) https://pharmexcil.com/uploads/countryreports/Germany-Regulatory_Market_ profile.pdf accessed 11 July 2023.

55Ruslan S Fyl and others, ‘Legal Regulation of the EU Pharmaceutical Market and the Possibility of Implementing the European Experience in Ukraine’ (2019) 9(4) Journal of Advanced Pharmacy Education and Research 1.

56In 2021, the Ukrainian pharmaceutical industry was among the ten biggest pharmaceutical industries in the Central and Eastern European. More detailed: ReportLinker, Pharmaceutical and Healthcare Industry in Ukraine: Forecast and Analysis 2021 (Aruvian's R'search 2021) https://www.reportlinker. com/p06103753/Pharmaceutical-and-Healthcare-Industry-in-Ukraine-Forecast-and-Analysis.html accessed 11 July 2023.

57‘EU–Ukraine Association Agreement “Quick Guide to the Association Agreement”’ (Delegation of the European Union to Ukraine, 25 September 2016) https://www.eeas.europa.eu/node/10418_en accessed 11 July 2023.

58Natalia Kochkina, Marketing Management: a Textbook (Interservis 2019).

59Compiled by the authors based on: Julia Albrecht and Gregor Kemper, The Pharmaceutical Industry in Germany: Industry Overview 2021/2022 (GTAI 2020) https://www.gtai.de/en/invest/service/publications/ the-pharmaceutical-industry-in-germany-63940 accessed 11 July 2023; ‘Darnitsa Pharmaceutical Company: History’ (Darnitsa, 2022) https://www.darnitsa.ua/en/history accessed 11 July 2023; Christina Economides, ‘EU’s New Pharmaceutical Strategy’ The National Law Review (Hinsdale IL, 3 December 2020) https://www.natlawreview.com/article/eu-s-new-pharmaceutical-strategy accessed 11 July 2023; European Medicines Agency, ‘Shortages Catalogue’ (European Medicines Agency, 2020) https://www.ema.europa.eu/en/human-regulatory/post-authorisation/availability-medicines/shortages- catalogue accessed 12 July 2023; Eurostat, ‘Medicine Use Statistics’ (Eurostat: Statistics Explained, 2021) https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Medicine_use_statistics accessed 11 July 2023; Eurostat, ‘Causes of Death Statistics’ (Eurostat: Statistics Explained, 2022) https://ec.europa. eu/eurostat/statistics-explained/index.php?title=Causes_of_death_statistics accessed 11 July 2023; Nathaniel Flakin, ‘Could Germany’s obsession with homeopathy explain the low vaccination rate?’ (Exberliner, 5 January 2022) https://www.exberliner.com/politics/germany-homeopathy-vaccination- rate-covid accessed 21 June 2023; Grand View Research, Europe Pharmaceutical Market Size, Share & Trends Analysis Report By Product (Branded, Generic), By Type (Prescription, OTC), By Therapeutic Category, By Region, And Segment Forecasts, 2021–2028 (Grand View Research 2021) https://www. grandviewresearch.com/industry-analysis/europe-pharmaceutical-market-report accessed 8 July 2023; Matej Mikulic, ‘Pharmaceutical Industry in Europe – Statistics & Facts’ (Statista, 31 August 2022) https://www.statista.com/topics/8631/pharmaceutical-industry-in-europe accessed 11 July 2023; OECD and European Union, Health at a Glance: Europe 2018: State of Health in the EU Cycle (OECD Pub 2018) 140-1, doi:10.1787/health_glance_eur-2018-en; Quintiles, ‘Market Access in the German Healthcare System: National and Subnational Structures to Help Navigate Complexity’ (IQVIA, 2015) https://www.iqvia.com/-/media/library/brochures/market-access-in-the-german-healthcare-system. pdf?vs=1 accessed 11 July 2023.

60Compiled by the authors based on: Albrecht and Kemper (n 59); Darnitsa (n 59); Economide (n 59); European Medicines Agency (n 59); Eurostat, Medicine (n 59); Eurostat, Causes (n 59); Flakin (n 59); Grand View Research (n 59); Mikulic (n 59); OECD and European Union (n 59); World Health Organization, Access to Medicines and Health Products Programme: Annual Report 2020 (WHO 2021) https://iris.who.int/handle/10665/342314 accessed 5 July 2023; Quintiles (n 59).

61Compiled by the authors based on the survey results.

62Klitschko https://klitschko.com/en accessed 11 July 2023.

63‘Chernobyl’ (The official podcast of the mini-series from HBO, 2022) https://www.hbo.com/chernobyl accessed 11 July 2023.

64Marc Santora, ‘Ghosts Past and Present Cross Paths as War Comes to Nuclear Wasteland’ The New York Times (New York, 14 April 2023) https://www.nytimes.com/2023/04/14/world/europe/chernobyl-russia- ukraine-war.html accessed 11 July 2023.

65Compiled by the authors based on the survey results.

66Compiled by the authors based on the survey results.

REFERENCES

-

Ahmed ZU and others, ‘Does Country of Origin Matter for Low-Involvement Products?’ (2004) 21(1) International Marketing Review 102, doi:10.1108/02651330410522925.

-