Summary: 1. Introduction. — 2. Literature review. — 3. Methodology. — 4. Data. — 5. Results. – 6. Limitations of the study. — 7. Conclusions. — 8. Discussion & Legal aspects.

ABSTRACT

Background:Our preliminary research shows that tax reform can have a meaningful impact in reducing the corporate shadow economy of a society. Countries are constantly applying lower tax rates to attract large businesses to their territory. They are also trying to improve tax collection efficiency in their jurisdiction area. We study the relationship between the Baltic countries' tax systems and the shadow economy level within their respective economies. Our research examines how economic growth can reduce the corporate shadow economy due to changes in tax collections.

Methods:Based on quarterly data from 2002-2022, a panel regression was chosen for the analysis, which allows for determining the impact of each specific tax on the level of the shadow economy separately, considering all three samples as one synergistic system.

Conclusion and recommendations:Thus far, we find that for all types of taxes, the models have the same structure, which allows for comparing the impact of gross domestic product on tax collections both in the short and long term. Our analysis showed that the effective income tax rate growth increases the shadow economy; that is, the country's citizens attempt to move into the shadows. At the same time, the growth of the effective corporate income tax rate, on the contrary, reduces the level of the shadow economy. A positive increase in the effective VAT rate also contributes to the growth of the shadow economy. The long-term effect for general taxes is almost 19% higher than the growth of the tax base. Thus, as to the Lithuanian economy, for example, it has a tendency for a reduction of the shadow economy, which means that there are significant opportunities for further improvement.

1 INTRODUCTION

The shadow economy, often referred to as the informal or underground economy, represents a significant challenge faced by many states worldwide. It encompasses a range of unreported economic activities and transactions that evade official monitoring, taxation, and regulatory oversight.5 The prevalence of the shadow economy poses numerous problems for governments, including revenue losses, distorted economic indicators, reduced social welfare programs, and decreased public trust in the tax system. Addressing the shadow economy has become a critical policy concern, and tax reform emerges as a potent instrument to illuminate this concealed realm.6

The persistent existence of the corporate shadow economy poses substantial challenges to governments worldwide. In response, countries are increasingly turning to tax reform as a potential means to reduce the prevalence of informal economic activities and enhance their tax collection efficiency. Numerous papers7 aim to emphasise the significant influence of tax reform in reducing the corporate shadow economy within society.8 To occupy this research gap, this paper delves into the complex interplay between tax regulation and the corporate shadow economy. It attempts to shed light on the existing challenges states face in combating the informal sector and explores the potential avenues for reducing its level, specifically focusing on the role of tax reforms. This research aims to offer valuable insights into the efficacy of tax regulation as a mechanism to curb shadow economic activities.

The corporate shadow economy, also known as the informal or underground economy, represents a pervasive challenge for governments across the globe.9 This hidden economic sector operates clandestinely, encompassing various unreported economic activities and transactions that evade official monitoring, taxation, and regulatory oversight. It exists parallel to the formal economy, thriving on tax evasion, labour informality, and cash transactions.10 The shadow economy not only distorts economic indicators but also undermines the integrity of the tax system, resulting in substantial revenue losses for governments. The widespread prevalence of the shadow economy places a substantial burden on national resources, hindering public welfare programs, infrastructure development, and investment in vital public services.11

The impact of the corporate shadow economy on governments is far-reaching and multifaceted. Firstly, the loss of tax revenues from the informal sector creates budgetary constraints, affecting the government's ability to fund essential services such as healthcare, education, and social welfare programs.12 This can lead to compromised public services and reduced quality of life for citizens.13 Secondly, the presence of unreported economic activities distorts official economic indicators, making it difficult for policymakers to accurately assess the true state of the economy and design appropriate economic policies.14 The shadow economy also fosters unfair competition, as businesses operating within the informal sector enjoy an advantage over compliant businesses due to lower operating costs and tax avoidance. This can deter formal businesses from operating legitimately, further exacerbating the problem.15

Addressing the shadow economy has become a pressing concern for governments seeking to foster sustainable economic growth and financial stability.16 One of the key instruments in combating the corporate shadow economy is tax reform. By reevaluating and restructuring tax policies, governments can incentivise businesses to transition from the informal to the formal sector. Lowering tax rates, simplifying tax systems, and implementing effective tax collection mechanisms can encourage compliance and discourage tax evasion. Furthermore, streamlined tax administration can enhance revenue generation capacity, providing governments with the necessary resources to invest in infrastructure, public services, and social welfare programs.17

Tax reform holds immense potential to reduce the prevalence of the corporate shadow economy and promote greater compliance within the formal economic sector.18 An efficient and welldesigned tax system can create a level playing field for businesses, ensuring fair competition and fostering an environment conducive to economic growth. By aligning tax policies with economic development goals, governments can incentivise businesses to operate within the formal economy, contributing to a more transparent and accountable economic landscape.19

Tax reform measures can also address the root causes of the shadow economy, such as high tax rates, complex tax structures, and burdensome compliance requirements. Lowering tax rates and simplifying tax regulations can reduce the incentives for tax evasion and encourage businesses to declare their income and operate legitimately.20 Implementing robust tax collection mechanisms, including digital payment systems and electronic invoicing, can enhance revenue collection efficiency and minimise opportunities for tax evasion.21

The Baltic region, comprising Estonia, Latvia, and Lithuania, is a focal point of this research on the corporate shadow economy and tax reform. These countries have experienced significant economic growth and development in recent years, making them an intriguing context for studying informal economic activities' prevalence and impact. This research aims to contribute to formulating evidence-based policy recommendations to help governments to reduce the corporate shadow economy and foster sustainable economic growth. Specifically, we focus on studying the relationship between the tax systems of the Baltic countries and the level of shadow economy prevalent in their respective economies.22

The paper's structure follows a logical sequence, starting with an introduction to the problem and research focus, followed by a review of related literature, detailed methodology, presentation of results, discussion of findings, conclusion, and suggestions for future research. The introduction introduces the problem of the corporate shadow economy and its significance for governments. It highlights the potential of tax reform as a means to address this issue and provides an overview of the research's focus on the tax systems (particularly of the Baltic countries). The literature review comprehensively reviews existing research and papers related to the shadow economy and tax regulation. So, this section establishes the context for the current study and identifies gaps in the literature that the research aims to address. The methodology part describes the research methodology, including the use of quarterly data from 2002 to 2022 and the adoption of a panel regression analysis. It explains how the data were collected and processed to assess the impact of specific taxes on the level of the shadow economy. The resulting part discusses the relationship between different tax rates and their influence on the shadow economy level, focusing on short-term and long-term effects. Discussion interprets and analyses the results in the context of the existing literature, drawing comparisons with previous studies on the shadow economy and tax reforms along with acknowledging any limitations in the study's methodology or data and suggests directions for future research to enhance the understanding of the shadow economy and its relationship with tax regulation. It discusses the implications of the findings and identifies potential policy measures to further reduce informal economic activities. The concluding part of the paper is the summary of the main findings and implications of the research. It emphasises the significance of tax reform in tackling the corporate shadow economy and proposes recommendations for policymakers based on the study's insights.

2 LITERATURE REVIEW

Due to the actors' efforts to avoid detection when conducting shadow economy activities, the shadow economy is, by its very nature, impossible to measure. The demand for details about the size of the shadow economy and its changes over time is driven by the political and economic significance of this information.

Additionally, formulating economic policies that react to changes in the economy over time and across space must consider all economic activity, including official and unofficial production of products and services. The magnitude of the shadow economy is also a key factor in determining how much tax evasion is occurring and, consequently, how much should be controlled.23 The amount of empirical research on the extent and evolution of the global shadow economy has significantly increased.24 The methods utilised to measure the shadow economy, pointing out their benefits and shortcomings, can be categorised as direct or indirect (including model-based) methods.25 As to four direct and micro methods of measuring the shadow economy, they are brief:26 measurement by the System of National Accounts Statistics — Discrepancy method; survey technique approach; the use of surveys of company managers; and the estimation of the consumption-income-gap of households. The majority of indirect strategies, often known as ‘indicator’ strategies, are macroeconomic in nature. These are partly based on, among other things, the discrepancy between national expenditure and income statistics, the discrepancy between the official and actual labour force, the ‘electricity consumption’ approach,27 the ‘monetary transaction’ approach,28 and the ‘currency demand’ approach.29 However, given that these activities are conducted at least in part for the same reasons as "pure" shadow economy activities, the macro approaches to estimating the shadow economy incorporate criminal activity, do-it-yourself activity, and voluntary activity. The beginning values for MIMIC estimates of the size of the shadow economy have a significant impact, and if they are derived from other macro figures, we run into the same issue. Thus, the literature review, which discusses different approaches in measuring, regulating and analysing shadow economy and approaches of tax application in regulations, came us to the following conclusions:

- There is no definitive approach as all methodologies, without exception, possess their strengths and weaknesses. Employing multiple methods whenever possible is advisable.

- Additional research is required to further investigate the estimation methodology and its outcomes in diverse countries and timeframes.

- It is crucial to establish satisfactory validation procedures for empirical findings, facilitating an informed assessment of their plausibility. An internationally recognised definition of the shadow economy is lacking, which is essential for facilitating crosscountry and cross-method comparisons and mitigating the issue of double counting.

Laffer approach.30 The Laffer curve postulates that at some tax rate, tax revenue maximises, but beyond that point, higher tax rates may lead to reduced compliance and decreased tax revenues. Policymakers often consider this approach when designing tax policies to balance revenue generation and encourage voluntary tax compliance31.

Determining the success of regulating the shadow economy requires comprehensive evaluation criteria. Common metrics include changes in tax compliance rates,32 formalisation of businesses,33 and reduction in unreported economic activities.34 Additionally, researchers often assess the impact of regulatory interventions on tax revenues, economic growth, and the overall integrity of the tax system. Successful regulation should lead to increased tax revenues, improved economic indicators, and a more transparent and accountable economic landscape.35

Researchers have extensively studied the relationship between taxes, tax reform, and the level of the shadow economy.36 Some studies have found that high tax rates can be a significant driver of informal economic activities, leading individuals and businesses to engage in tax evasion to reduce their tax burden.37 On the other hand, tax reforms that lower tax rates and simplify tax systems have been shown to incentivise compliance, leading to a reduction in the shadow economy's size.38

The impact of tax reform on the shadow economy is often contingent on the specific context and design of the reforms. Some studies have suggested that comprehensive tax reforms, accompanied by tax administration and enforcement improvements, can yield more significant reductions in the shadow economy.39 Additionally, the effectiveness of tax reform may vary across different countries and timeframes, necessitating a careful examination of the local economic and social conditions.40

However, researchers also highlight the importance of complementary measures in conjunction with tax reform to achieve successful regulation of the shadow economy.41 Measures such as improving the business environment, reducing bureaucratic hurdles, and enhancing legal enforcement can reinforce the impact of tax interventions.

The Baltic region has been grappling with the issue of the shadow economy, which refers to the informal economic activities that operate outside the purview of official monitoring and taxation. Despite significant economic growth and development in countries like Estonia, Latvia, and Lithuania, the shadow economy remains a concern.42 The prevalence of the shadow economy poses challenges for governments in the region, impacting tax revenues, distorting economic indicators, and hindering efforts to foster a transparent and accountable economic environment

The shadow economy in the Baltic countries encompasses many activities, including unreported income, cash transactions, and under-the-table payments.43 The informal sector has implications for businesses and the government alike. Informal economic activities can distort fair competition and deter formal businesses from operating legitimately, creating an uneven playing field. This can potentially hinder investment and economic growth in the region.

Tax evasion is a significant aspect of the shadow economy in the Baltic countries.44 High tax rates and complex tax structures may incentivise businesses and individuals to underreport their income or engage in other tax evasion practices. The lack of adequate tax compliance can result in substantial revenue losses for the government, impacting its ability to fund public services and welfare programs.

Addressing the shadow economy in the Baltic region requires a comprehensive approach that involves effective tax reforms, streamlined tax administration, and improved enforcement measures. Governments can increase tax compliance and enhance revenue collection by implementing measures to incentivise businesses to operate within the formal sector. Creating a conducive business environment with lower tax burdens and simplified tax regulations can also encourage businesses to opt for formal operations. Understanding the dynamics and extent of the shadow economy in the Baltic region is crucial for formulating evidence-based policies to tackle this issue effectively. Research and analysis in this area can provide valuable insights into the drivers of informal economic activities and inform policymakers about the potential role of tax reform as a tool to curtail the shadow economy's expansion and foster a more transparent and accountable economic landscape in the Baltic countries.

The crucial factor to indicate is the impact of the COVID-19 period. According to Schneider (2022),45 the average size of the shadow economy in 36 European and OECD countries decreased from 16.48% of GDP in 2020 to 16.07% in 2021 (a decline of 0.41 percentage points) when taking into account the development of the shadow economy over the period from 2003 to 2022 and the impact of the Coronavirus pandemic from 2020 onward. The average shadow economy of these 36 countries will marginally climb to 15.96% of GDP (average of all 36 countries) in 2022 as a result of a prolonged (forecasted) economic recovery: a very minor decrease of 0.11 percentage points. Nearly all OECD and European countries experienced a severe recession in 2020 and, to a lesser extent, in 2021 due to the coronavirus pandemic.

The recession led to a significant increase in unemployment and a impulsive decrease in GDP and national income. These significant underlying causes of the shadow economy's growth resulted in significantly boosting the shadow economies of these 36 nations.

3 METHODOLOGY

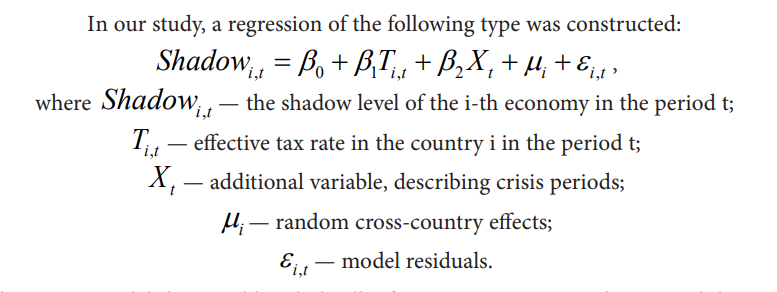

The study examines the relationship between the tax systems of the Baltic countries and the level of shadow economy within their respective economies.

Despite many similarities, Baltic countries have some differences in tax rates and methodology of calculating tax obligations. In Estonia and Latvia, corporate income tax (CIT) is payable upon profit distributions at a 20% rate, while in Lithuania, the tax rate is 15%. However, a 20% CIT rate is applicable to credit institutions, and 0% and 5% rates may be applied under certain conditions. The main PIT (personal income tax) rate is 20% in Baltic countries. At the same time, in Estonia, a monthly basic exemption (EUR 654) is not taxed; in Latvia, there are 23 and 31% rates for high incomes; and in Lithuania — 32% for high incomes. The value-added tax also varies among countries. The main tax rate is almost similar (20% in Lithuania, 21% in Latvia and Estonia), but lower rates can be applied: in Estonia, 9% and 0%; in Latvia — 12% and 5%; in Lithuania — 9% 5% and 0%46. It should also be noted that tax rates have changed several times during the investigated period. Considering such differences, we consider only effective tax rates, which count real payments to the GDP level, and neglect different rates and conditions of payment.

We consider the following hypothesis: the effective tax rate affects the level of the shadow economy

It is clear that the rate of a specific tax cannot serve as a relevant influencing factor, as countries avoid changing them often. In most cases, the rates of basic taxes do not change for decades.47 That is why a more informative indicator was chosen for the analysis — the so-called effective tax rate, which is determined by the ratio of actually collected taxes for a certain period to the country's GDP for that same period.48 49 Accordingly, effective rates of basic taxes and the level of the shadow economy are used to analyse tax changes. The latter indicator is taken from the works of F. Schneider, which is currently the most objective measure of the shadow economy.50

F. Schneider's approach to calculating the shadow economy level involves a comprehensive and multifaceted methodology considering various economic indicators and factors contributing to the informal economy. One of the key components of his approach is the ‘currency demand approach’, where he estimates the size of the shadow economy by analysing the discrepancy between the money supply and the actual currency held by the public. By assessing the difference between the two, F. Schneider can approximate the extent of unreported economic activities and cash transactions not captured by official statistics.

Furthermore, F. Schneider incorporates the ‘structural equation modelling’ (SEM) technique in his methodology. SEM allows him to establish causal relationships among variables that influence the size of the shadow economy. By identifying factors such as tax burden, regulations, labour market conditions, and corruption, he can discern how these elements affect the level of informal economic activities in a given country. This holistic approach enables F. Schneider to analyse various socio-economic factors' direct and indirect effects on the shadow economy level, providing a more comprehensive understanding of the informal sector's dynamics.51

F. Schneider's approach to calculating the shadow economy level is a rigorous and systematic methodology combining currency demand analysis with structural equation modelling.52 By integrating diverse economic indicators and considering complex interactions between different variables, his approach provides valuable insights into the size and drivers of the informal economy. The findings derived from this method contribute to a more nuanced understanding of the economic landscape, assisting policymakers and researchers in formulating strategies to address and mitigate the challenges posed by the shadow economy.53

The working assumptions are as follows:

- All three countries under consideration are in a related synergy in terms of state regulation of taxes and capital movement.

- If the corresponding coefficient of the model is significant and negative with the growth of the effective tax rate, then the state has managed to collect adequate taxes and bring the corresponding share of the economy out of the shadows.

- If the corresponding coefficient is significant and positive with the growth of the effective tax rate, it can be concluded that the state failed to collect all possible taxes, and some of them went into the shadows.

- If the corresponding coefficient of the model is found to be insignificant, it can be assumed that the corresponding tax is not a significant channel for businesses to enter the shadow economy. The significance of the coefficient, accordingly, shows that this tax is a primary channel for entering the shadow economy and can be regulated by the state.

- When significant, the constant of the model can be an indicator of the level of the shadow economy without the influence of state tax levers.

Based on the first assumption, a panel regression was chosen for the analysis, which allows for determining the impact of each specific tax on the level of the shadow economy separately, considering all three samples as one synergistic system. It should be noted that it was decided not to build separate regression lines for each country precisely because of the similarity of the states' economies. The model's choice depends on the study's specific circumstances and features. Typically, a fixed-effects model is used when one is interested in studying the effect of time-varying variables, while a random-effects model is used when the interest is in the overall sample effect. The Hausman test is often used to compare fixed- and random-effect models. If the test results show that a fixed-effect model is better, this may mean that the objects under study have constant characteristics important for modelling. If the randomeffect model is better, it may mean that the objects have different characteristics that cannot be captured by the fixed effects.

Studying one model that would include all effective tax rates seemed irrational due to the possible level of multicollinearity between indicators. The presence of the additional variable X is explained by the dramatic changes in tax collection during two periods: in 2009 after the global financial crisis and in 2020 during the COVID-19 pandemic.

4 DATA

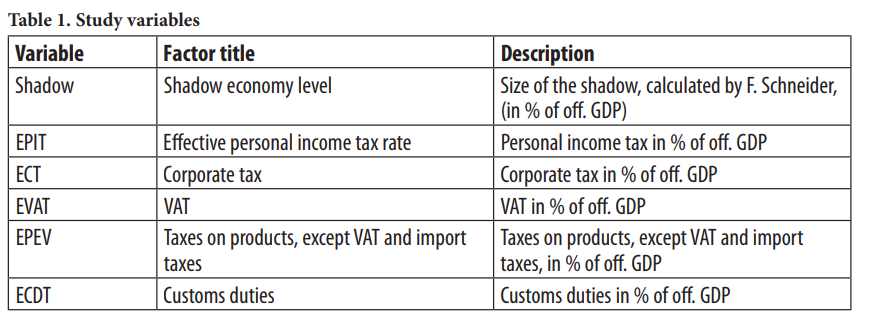

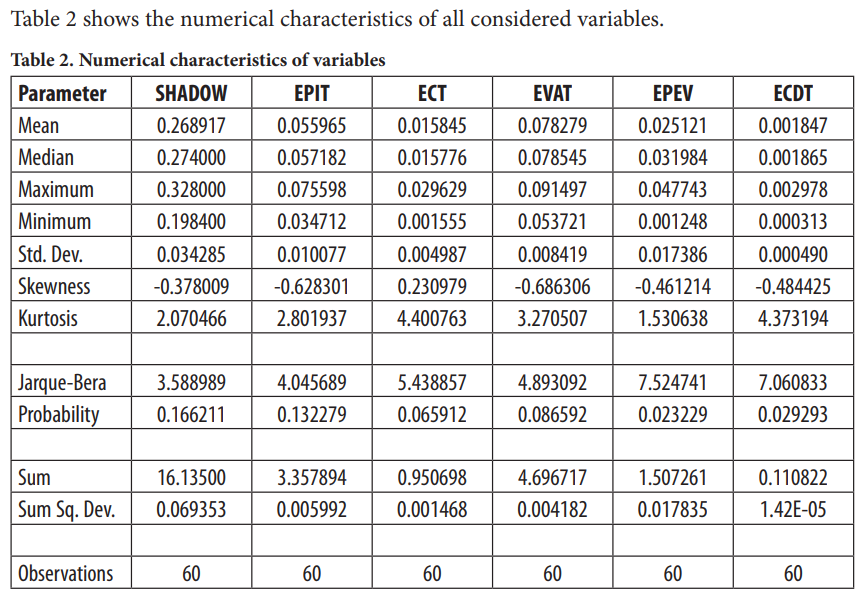

The study compares the situation in three countries that have a lot in common in the economy: Lithuania, Latvia and Estonia. All three countries were members of the USSR and then underwent economic transformation, joining the European Union and introducing the euro as their national currency. These countries are located next to each other, have access to the sea, and accordingly have a relatively similar structure of economy. This makes it possible to analyse the level of the shadow economy in countries according to the same principle. The main data used in the work are the following (Table 1). Data from 2002 to 2021 were used for the analysis, allowing for forming a weighted dated panel.

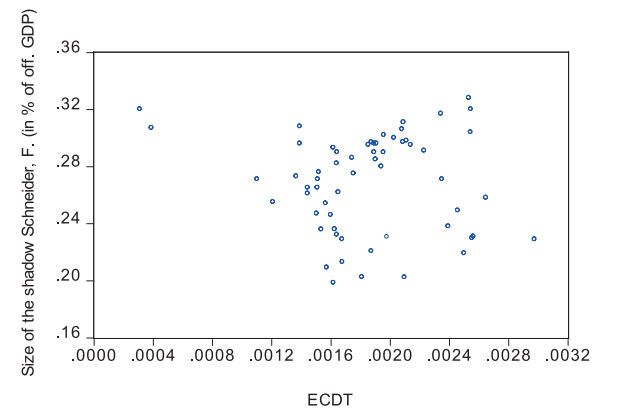

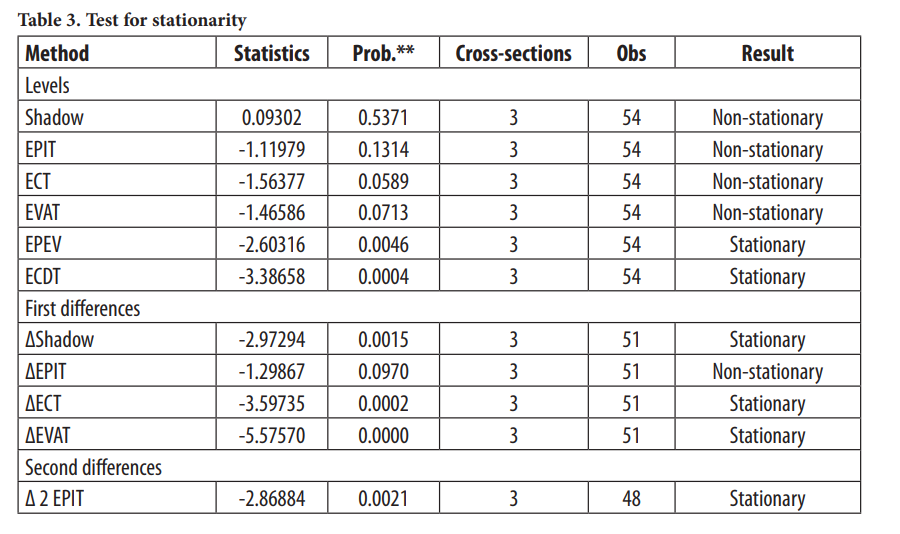

The initial stage of the research is testing the stationarity of the variables. For this, the Levin, Lin & Chu t-test for panel data was used. Most indicators were stationary in the first difference. However, the EPIT variable became stationary only in the second difference, and the EPEV and ECDT variables were stationary in levels (Table 3).

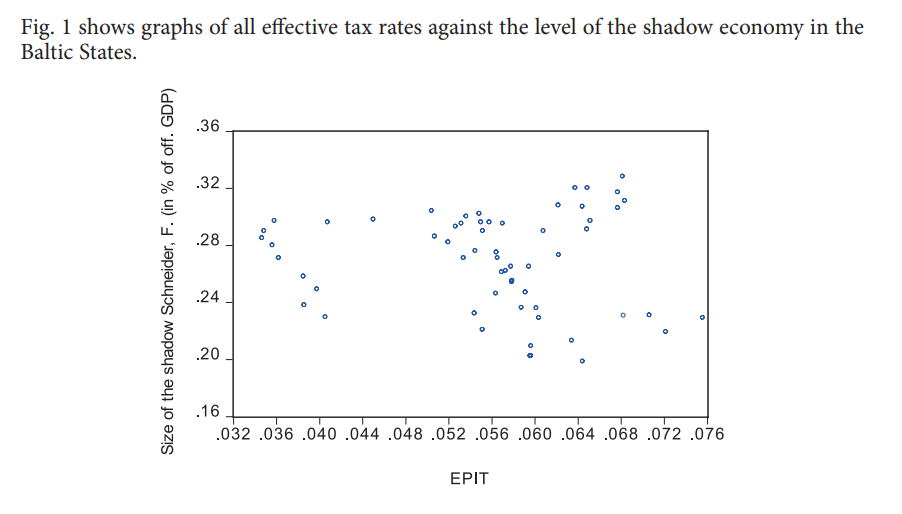

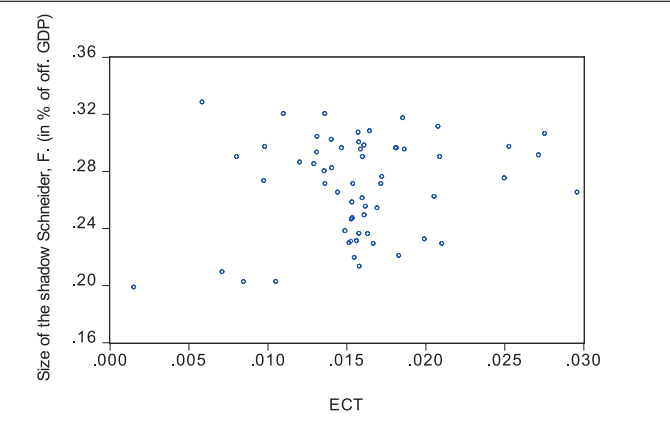

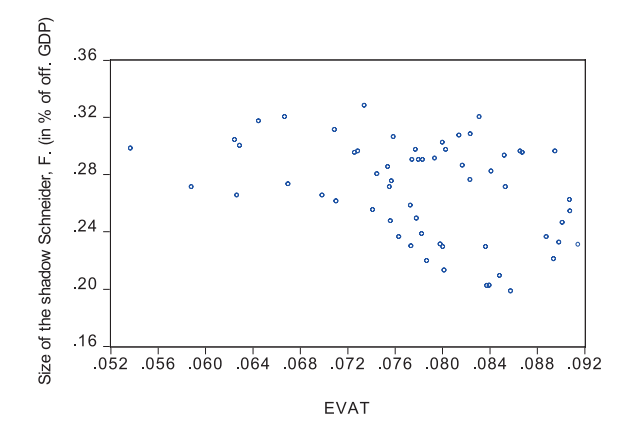

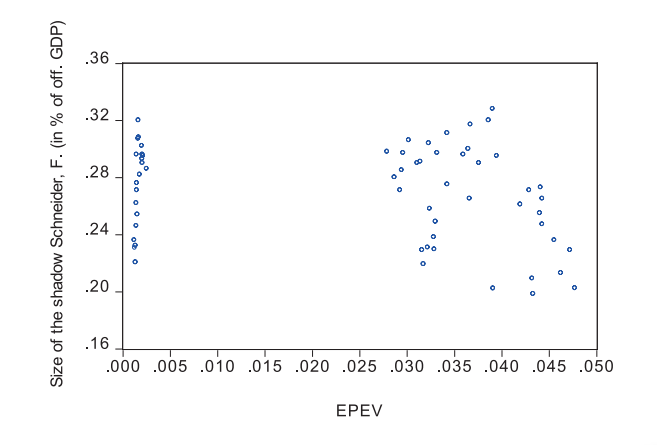

5 RESULTS

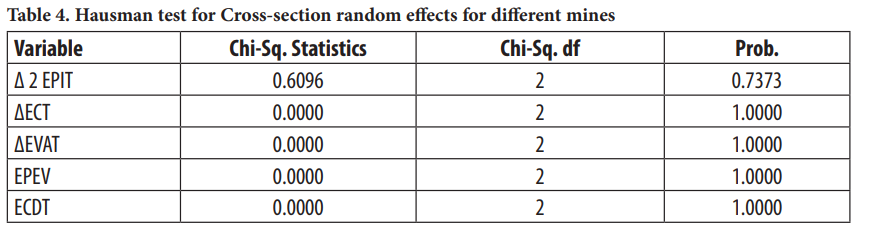

Based on the data, you can build a model that will reflect the relationship between the dependent and independent variables. When analysing panel data, choosing which of the models is most suitable for a particular situation is necessary. The model with fixed effects should be used when each economic unit is "special" and cannot be considered as the result of a random selection from some general population. A model with random effects is better because it is more "compact" and has fewer parameters; it can be considered a partial case of a model with fixed effects. Since the most important difference between the approaches to modelling the heterogeneity of observation objects is the ratio of the impact and regressors, random results are not correlated with regressors. In contrast, fixed effects can be associated with them. Choosing a fixed or random effects model depends on whether the effects correlate with the regressors. Under fair conditions, fixed-effects model estimates are robust, and random-effects model estimates are consistent. In this case, significant differences between the estimates of these models can be expected. Detection of such a difference is investigated using the appropriate test based on the Hausman statistic.

A version of the model with random effects for countries and no results for periods was chosen for the work. The Hausman test confirms the presence of random effects for countries (Table 4).

At the same time, the impact of effects on the periods was not investigated due to significant fluctuations in 2009 and 2020 caused by the consequences of the global financial crisis and the pandemic. Taking this influence into account was more appropriate than constructing additional effects. In some models, it was essential to study the impact of only 2020 (variable Y20), while in others, both 2009 and 2020 were studied simultaneously (variable Y_09_20). The choice of such a model was also influenced by the number of available observations, which did not allow for simultaneously building a regression with random effects across countries and periods. The least squares method for panel regression was used for estimation, and the aggregated assessment results are given in Table 5.

The table shows that the impact of taxes is multifaceted, although the NO hypothesis is confirmed for all types of taxes except for EPEV and ECDT. In particular, the effective income tax rate growth leads to an increase in the shadow economy; that is, the country's citizens try to go into the shadows. At the same time, the growth of the effective corporate income tax rate, on the contrary, reduces the level of the shadow economy. A positive increase in the effective VAT rate also contributes to the growth of the shadow economy. However, the simulation showed an insignificant effect of various effective taxes on imports to regulate the level of the shadow economy.

Such a situation is not a surprise: the increase in payments to the budget is often perceived by the population as an incentive to avoid taxation through various schemes. This means that with an increase in the effective tax rate on citizens' incomes, the process of tax evasion develops. A similar approach can be observed with the payment of VAT, where there are various VAT refund schemes for exporters, fictitious imports, etc. However, an increase in corporate income tax, on the contrary, reduces opportunities for the withdrawal of funds abroad, which means tax evasion. The simulation showed approximately the exact impact of 2009 and 2020 on the level of the shadow economy. These years, they have contributed to an increase in the shadow economy by slightly more than one and a half per cent.

6 LIMITATIONS OF THE STUDY

Of course, the obtained results are based on assumptions about the impact of tax policy on the level of shadowing of the economy. On the one hand, this connection is confirmed by the model considered in the work and other analysed studies. On the other hand, a radical change in tax policy rarely leads to significant changes in shadowing, so it can be assumed that there is a deeper and more inert relationship between the level of shadowing and taxes. However, the study of such an effect must rely primarily on long-term data, free from the influence of the phase transition that we currently observe. Indeed, the reorientation of people from the sphere of production to the sphere of services, especially those that can be provided remotely, has significantly changed the perception of the effectiveness of tax policy. Thus, it is possible to investigate other factors that determine both the inertness of shading in the country and changes in its level due to the influence of these new factors. Unfortunately, it was impossible to consider them in our study

Another limitation is using a panel regression tool for the similar development of the Baltic countries. Since these countries implement approximately the same tax policy and have similar economic structures, it is clear that the simulation results for them turned out to be similar. However, it is possible that for other countries, the simulation results will require using tax variables in other functional forms, which may lead to slightly different conclusions. In any case, the tax impact on the level of shadowing should also be investigated for countries in other regions.

7 CONCLUSIONS

The desire to attract large businesses and foster economic growth drives countries to explore measures such as applying lower tax rates and enhancing tax collection methods. To investigate the dynamics between economic growth and the corporate shadow economy, we examine changes in tax collections for 3 Baltic states. Our analysis utilises quarterly data spanning from 2002 to 2021, employing a panel regression approach to assess the impact of individual taxes on the shadow economy level collectively.

The literature review presented highlights various methodologies used to analyse and regulate the shadow economy, with special emphasis on tax-related interventions such as the Laffer approach. Measurement of success in regulating the shadow economy involves assessing changes in tax compliance, formalisation of businesses, and overall economic indicators. Existing research indicates that tax rates and tax reform play a significant role in influencing the level of the shadow economy, but the effectiveness of such interventions is contextdependent. To achieve meaningful results, policymakers must consider a combination of tax reform and complementary measures aimed at creating an enabling environment for businesses to operate within the formal economy. Further research is required to deepen our understanding of the complexities of the shadow economy and identify the most effective strategies for its successful regulation.

In conclusion, this analysis focused on constructing a model to examine the relationship between the dependent and independent variables in the context of the shadow economy. Panel data analysis was used, and the choice between fixed and random effects models was discussed. The model with random effects for countries and no effects for periods were selected for this study. The Hausman test confirmed the presence of random effects for countries. The study investigated the impact of taxes on the shadow economy, particularly the effective income tax rate, effective corporate income tax rate, and effective VAT rate.

The results revealed a multifaceted nature of the impact of taxes on the shadow economy. The effective income tax rate increase leads to an increase in the shadow economy, indicating that citizens attempt to evade taxes. In contrast, the growth of the effective corporate income tax rate reduces the level of the shadow economy, possibly due to reduced opportunities for offshore fund withdrawal. A positive increase in the effective VAT rate also contributes to the growth of the shadow economy, attributed to various VAT refund schemes and fraudulent imports. An increase in payments to the budget can be perceived as an incentive to avoid taxation, leading to tax evasion through various schemes. While these findings align with expectations, they underscore the importance of designing tax policies carefully to mitigate tax evasion risks.

Due to significant fluctuations in 2009 and 2020 caused by the global financial crisis and pandemic, the impact of effects on the periods still needs to be thoroughly investigated. The choice of the model was also influenced by the availability of observations, leading to a focus on the impact of either 2020 alone or both 2009 and 2020 simultaneously

The research contributes valuable insights into the complexity of regulating the shadow economy through tax interventions. It emphasises the need for well-balanced tax policies that promote tax compliance while considering the diverse impact of different taxes on informal economic activities. Further exploration and validation of these findings are crucial to developing targeted policies that effectively curtail the shadow economy and promote transparent, sustainable economic growth in the long run.

Based on the above conclusions, the tax regulating system for Baltic countries plays a pivotal role in addressing the shadow economy. Policymakers in Estonia, Latvia, and Lithuania must carefully consider the impact of tax policies on informal economic activities. To reduce tax evasion and encourage tax compliance, tax reform should focus on simplifying tax structures, lowering tax rates, and enhancing tax enforcement measures. Additionally, efforts should be made to improve tax collection efficiency and transparency to deter businesses and individuals from engaging in unreported economic activities.

The findings also shed light on possibilities to change the shadow economy in the Baltic countries. Policymakers should leverage the insights gained from the impact of different taxes on informal economic activities. For instance, the reduction of the effective corporate income tax rate has shown promise in reducing the shadow economy. Implementing targeted tax incentives for businesses to operate within the formal economy and promoting transparency in financial transactions can further reduce the shadow economy's size.

8 DISCUSSION & LEGAL ASPECTS

Understanding the legal facets of the shadow economy is crucial for comprehending the legal framework and countermeasures that are employed. Tax legislation, which sets the tax liabilities of individuals and businesses, is one of the most crucial. Businesses must accurately record their revenue and make timely tax payments. Additionally, the consequences and sanctions for tax evasion have a big impact on preventing people from engaging in illegal economic activities.

Laws against money laundering and corruption are also essential for thwarting the illegal financial activities connected to the shadow economy. These legal frameworks are designed to stop money laundering and guarantee financial transaction transparency. To control the shadow economy, effective legislative measures and enforcement procedures are necessary.

The fight against the shadow economy in the Baltic States also requires certain legal considerations that are tailored to the distinct socioeconomic circumstances of Estonia, Latvia, and Lithuania. To encourage companies and individuals to accurately record their revenue and comply with their tax obligations, tax authorities in these nations implement a number of different strategies. The Baltic States have recently tightened their legal systems to fight corruption and money laundering. These steps are essential to do in order to stop illegal financial activity connected to the shadow economy, such as tax fraud and money laundering. The Baltic nations work to promote financial transaction transparency and safeguard their economies from the damaging effects of the shadow economy by bolstering their legislative frameworks.

The Baltic States can contribute to a more transparent and accountable economic environment by implementing robust legislative measures and promoting compliance, ensuring sustainable economic growth and development. While tackling the shadow economy through tax reforms is important, governments in these countries must be mindful of tax competition between states. Lowering tax rates to attract business and investment can inadvertently lead to a raceto-the-bottom scenario where countries engage in aggressive tax competition, reducing their revenue potential and exacerbating the shadow economy. Policymakers should consider a joint approach to find a balance between attracting investment and maintaining stable tax revenues. However, it is the models of this study that suggest that a particularly sharp reaction to the "race to the bottom" scenario may not occur in the long run, just like the "race to the top" scenario.

As a result, the coordination and harmonization of tax laws across the Baltic States already suffice to reduce tax rivalry and foster regional economic growth. By lowering incentives for enterprises to relocate to the unofficial sector to evade taxes, encouraging fair tax policies and cooperation can result in a more stable business environment.

Future research could look at the effects of additional elements including economic growth, the regulatory environment, and technological advancement on the informal sector because it is a complex and diverse phenomenon. Additionally, studies should look into the success of particular tax reform initiatives in the Baltic States' struggle against the shadow economy. Comparative research can be done to evaluate how various tax policy strategies operate in surrounding areas and in other nations dealing with comparable issues.

Furthermore, further research is needed to understand how the epidemic and the global financial crisis have affected the shadow economy. Such external shocks should be studied in order to understand how they impact the informal economy and how governments might respond by implementing specific fiscal and economic policie

The initial findings of this paper reveal a consistent structure in the models for all types of taxes, enabling comparisons of the impact of gross domestic product on tax collections both in the short and long term. Notably, our research shows that an increase in the effective income tax rate leads to a rise in the shadow economy as citizens seek to evade higher tax burdens. In contrast, a higher effective corporate income tax rate has the opposite effect, reducing the level of the shadow economy. Furthermore, a positive increase in the effective VAT rate also contributes to the growth of the shadow economy. Overall, the long-term effect of general taxes surpasses the growth of the tax base by nearly 19%, indicating a tendency towards reducing the shadow economy in these states. To overcome the challenges of the shadow economy, governments must implement a well-balanced tax regulatory framework that encourages compliance and encourages formal economic activity. The study provides opportunities for targeted tax reforms and policy interventions, contributing to the region's efforts to reduce the shadow economy and promote sustainable economic growth. Further research in this area will be important for formulating adequate and effective evidence-based strategies to address the problems of the shadow economy in the Baltic States and beyond.

This study's implications are promising, suggesting significant opportunities for further improvement and policymaking interventions to mitigate the corporate shadow economy's impact on the economy of these states. By investigating the relationship between tax reform measures and the level of informal economic activities, this research seeks to offer valuable insights into the potential of tax regulations as a potent tool in the fight against the corporate shadow economy. Through evidence-based analysis, we aim to contribute to the formulation of effective policies that can foster sustainable economic growth and bolster formal economic activities while discouraging the prevalence of unreported economic practices.

In addition to adjusting the tax policy, legal measures play an important role in the effective fight against the shadow economy. In this perspective, it is possible to offer the following legal recommendations for the Baltic countries to strengthen the regulatory framework and reduce the prevalence of informal economic activity and tax evasion:

- Strengthening tax control and penalties: enhancing tax systems to find and stop tax evasion. This involves stepping up the use of cutting-edge technologies for real-time data processing, risk analysis, and transaction monitoring. To effectively dissuade non-compliant organizations and individuals, tougher penalties and sanctions for tax evasion should be implemented.

- Promoting whistleblower protection: Providing protection and encouragement to whistleblowers can lead to more effective detection and prosecution of the shadow economy.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Compliance: Strengthen AML and KYC regulations to prevent money laundering and illegal financial activities related to the shadow economy. Financial institutions should be required to implement strict due diligence measures when dealing with high-risk clients and transactions.

- Encouraging voluntary tax compliance and training: promoting a culture of voluntary tax reporting and creating an image of the positive impact of taxes on public services and infrastructure development.

- Cooperation with law enforcement agencies: to break the relationship between the shadow economy and organized crime, encourage better communication between tax officials and law enforcement organizations. Information and intelligence exchange can aid in more efficient criminal investigation and prosecution.

- Encouraging self-regulation in specific sectors: Cooperation with industry associations and professional organizations to promote self-regulation in specific sectors prone to informal economic activity. Encourage businesses in these sectors to voluntarily apply best practices and ethical standards.

- Periodic review and updating of the legislative framework: legislation must adapt to changing economic and technological landscapes to effectively curb informal economic activity, in particular, taking into account the results of data analysis and model scenarios.

In summary, a comprehensive legal approach combined with targeted tax policy adjustments is essential to successfully combat the shadow economy in the Baltic States.

5Alla Sokolovska and others, ‘The Impact of Globalization and International Tax Competition on Tax Policies’ (2020) 11(4) Research in World Economy 1, doi:10.5430/rwe.v11n4p1.

6Erstida Ulvidienė and others, ‘An Investigation of the Influence of Economic Growth on Taxes in Lithuania’ (2023) 102(1) Ekonomika 41, doi: 10.15388/Ekon.2023.102.1.3.

7Solis-Garcia, M., & Xie, Y. (2018). Measuring the size of the shadow economy using a dynamic general equilibrium model with trends. Journal of Macroeconomics, 56, 258-275. https://doi.org/10.1016/j. jmacro.2018.04.004

8Leandro Medina and Friedrich G Schneider, ‘Shedding Light on the Shadow Economy: A Global Database and the Interaction with the Official One’ (2019) 7981 CESifo Working Paper, doi:10.2139/ssrn.3502028.

9Daniel Němec and others, ‘Corruption, Taxation and the Impact on the Shadow Economy’ (2021) 9(1) Economies 18, doi:10.3390/economies9010018.

10Van Cuong Dang, Quang Khai Nguyen and Xuan Hang Tran, ‘Corruption, Institutional Quality and Shadow Economy in Asian Countries’ (2022) Applied Economics Letters, doi:10.1080/13504851.2022.2118959.

11Monica Violeta Achim and others, ‘The Shadow Economy and Culture: Evidence in European Countries’ (2019) 57(5) Eastern European Economics 352, doi:10.1080/00128775.2019.1614461.

12Petr Janský and Miroslav Palanský, ‘Estimating the Scale of Profit Shifting and Tax Revenue Losses Related to Foreign Direct Investment’ (2019) 26 International Tax and Public Finance 1048, doi:10.1007/ s10797-019-09547-8.

13Mak B Arvin, Rudra P Pradhan and Mahendhiran S Nair, ‘Are there Links between Institutional Quality, Government Expenditure, Tax Revenue and Economic Growth? Evidence from Low-Income and Lower Middle-Income Countries’ (2021) 70(C) Economic Analysis and Policy 468, doi:10.1016/j.eap.2021.03.011.

14Cong Minh Huynh and Tan Loi Nguyen, ‘Fiscal Policy and Shadow Economy in Asian Developing Countries: Does Corruption Matter?’ (2020) 59(4) Empirical Economics 1745, doi:10.1007/s00181- 019-01700-w

15Halyna Mishchuk and others, ‘Impact of the Shadow Economy on Social Safety: The Experience of Ukraine’ (2020) 13(2) Economics and Sociology 289, doi:10.14254/2071-789X.2020/13-2/19.

16Erstida Ulvidienė and others, ‘The Relationship between GDP and Tax Revenues from the Market of Gambling and Lotteries in Lithuania’ (2023) 1(222) Bulletin of Taras Shevchenko National University of Kyiv, Economics, doi:10.17721/1728-2667.2023/222-1/19.

17 Anna Karolak, ‘Adaptation Process of a Polish Tax Law to European Union Norms –Harmonization of a Value Added Tax’ (2011) 4(1) Economics and Sociology 54, doi:10.14254/2071-789X.2011/4-1/6.

18Nguyen Vinh Khuong and others, ‘Does Corporate Tax Avoidance Explain Cash Holdings? The Case of Vietnam’ (2019) 12(2) Economics and Sociology 79, doi:10.14254/2071-789X.2019/12-2/5.

19Orkhan Nadirov, Bruce Dehning and Drahomira Pavelkova, ‘Taxes and the Incentive to Work under Flat and Progressive Tax Systems in Slovakia’ (2021) 14(2) Economics and Sociology 40, doi:10.14254/2071- 789X.2021/14-2/2.

20Olena Liakhovets, ‘Tax Incentives Effectiveness for the Innovation Activity of Industrial Enterprises in Ukraine’ (2014) 7(1) Economics and Sociology 72, doi:10.14254/2071-789X.2014/7-1/7.

21Ulvidienė and others (n 6).

22Sokolovska and others (n 5).

23Leandro Medina and Friedrich Schneider, Shadow Economies Around the World: What Did We Learn Over the Last 20 Years? (WP/18/17, IMF 2018) doi:10.5089/9781484338636.001.

24Alexander D Klemm and others, Are Elasticities of Taxable Income Rising? (WP/18/132, IMF 2018) doi:10.5089/9781484361566.001; Medina and Schneider (n 23).

25Friedrich Georg Schneider and Dominik H Enste, Hiding in the Shadows: The Growth of the Underground Economy (Economic Iss 30, IMF 2002); Lars P Feld and Friedrich Georg Schneider, ‘Survey on the Shadow Economy and Undeclared Earnings in OECD Countries’ (2010) 11(2) German Economic Review 109, doi:10.1111/j.1468-0475.2010.00509.x; Colin C Williams and Friedrich Schneider, Measuring the Global Shadow Economy: The Prevalence of Informal Work and Labour (Edward Elgar Pub 2016) doi:10.4337/9781784717995

26Friedrich Schneider and Andreas Buehn, ‘Shadow Economy: Estimation Methods, Problems, Results and Open questions’ (2018) 1(1) Open Economics 1, doi:10.1515/openec-2017-0001.

27Daniel Kaufmann and Aleksander Kaliberda, Integrating the Unofficial Economy into the Dynamics of Post Socialist Economies: A Framework of Analysis and Evidence (Policy Research Working Paper 1691, World Bank 1996) doi:10.1596/1813-9450-1691.

28Edgar L Feige, ‘How Big is the Irregular Economy?’ (1979) 22(5) Challenge 5, doi:10.1080/05775132.1 979.11470559.

29Edgar L Feige, ‘A Re-Examination of the “Underground Economy” in the United States: A Comment on Tanzi’ (1986) 33(4) IMF Staff Papers 768, doi:10.2307/3867216.

30F Guedes de Oliveira and Leonardo Costa, ‘The VAT Laffer Curve and the Business Cycle in the EU27: An Empirical Approach’ (2015) 20(2) Economic Issues 29.

31Normann Lorenz and Dominik Sachs, ‘Identifying Laffer Bounds: A Sufficient‐Statistics Approach with an Application to Germany’ (2016) 118(4) Scandinavian Journal of Economics 646, doi: 10.1111/ sjoe.12170.

32James Alm, Ali Enami and Michael McKee, ‘Who Responds? Disentangling the Effects of Audits on Individual Tax Compliance Behavior’ (2020) 48(2) Atlantic Economic Journal 147, doi:10.1007/s11293- 020-09672-4.

33Anastasiia Samoilikova, ‘Financial Policy of Innovation Development Providing: The Impact Formalization’ (2020) 4(2) Financial Markets, Institutions and Risks 5, doi:10.21272/fmir.4(2).5-15.2020.

34Andrew J Temple and others, ‘Illegal, Unregulated and Unreported Fishing Impacts: A Systematic Review of Evidence and Proposed Future Agenda’ (2022) 139(3) Marine Policy 105033, doi:10.1016/j. marpol.2022.105033.

35Stefan Kirchner and Elke Schüßler, ‘Regulating the Sharing Economy: A Field Perspective’ in Indre Maurer, Johanna Mair and Achim Oberg (eds), Theorizing the Sharing Economy: Variety and Trajectories of New Forms of Organizing (Research in the Sociology of Organizations 66, Emerald Pub 2020) 215, doi:10.1108/S0733-558X20200000066010.

36Ben Kelmanson and others, Explaining the Shadow Economy in Europe: Size, Causes And Policy Options (WP/19/278, IMF 2019) doi:10.5089/9781513520698.001.

37Ogunshola Idowu Bello and Karina Kasztelnik, ‘Observational Study of Tax Compliance and Tax Evasion in Nigeria’ (2022) 6(4) Financial Markets, Institutions and Risks 1, doi:10.21272/fmir.6(4).1-14.2022.

38Fazle Rabbi and Saad Saud Almutairi, ‘Corporate tax avoidance practices of multinationals and country responses to improve quality of compliance’ (2021) 15(1) International Journal for Quality Research 21, doi:10.24874/IJQR15.01-02.

39Franziska Ohnsorge and Shu Yu (eds), The Long Shadow of Informality: Challenges and Policies (World Bank Pub 2022).

40Wilson Prichard and others, Innovations in Tax Compliance: Conceptual Framework (Policy Research Working Paper 9032, World Bank 2019).

41Aleksandra Fedajev and others, ‘Factors of the Shadow Economy in Market and Transition Economies During the Post-Crisis Period: Is There a Difference?’ (2022) 33(3) Inžinerinė Ekonomika 246, doi:10.5755/ j01.ee.33.3.28417.

42Romualdas Ginevicius and others, ‘The Impact of National Economic Development on the Shadow Economy’ (2020) 12(4) Journal of Competitiveness 39, doi:10.7441/joc.2020.04.03.

43Korhan K Gokmenoglu and Aysel Amir, ‘Investigating the Determinants of the Shadow Economy: The Baltic Region’ (2023) 61(2) Eastern European Economics 181, doi:10.1080/00128775.2022.2163905.

44Behrooz Gharleghi and Asghar Afshar Jahanshahi, ‘The Shadow Economy and Sustainable Development: The Role of Financial Development’ (2020) 20(3) Journal of Public Affairs e2099, doi:10.1002/pa.2099.

45Friedrich Schneider, ‘New COVID-Related Results for Estimating the Shadow Economy in the Global Economy in 2021 and 2022’ (2022) 19(2) International Economics and Economic Policy 299, doi:10.1007/ s10368-022-00537-6.

46‘Baltic Tax Rates from 1 january 2023’ (Leinonen Lithuania, 19 January 2023) https://leinonen.eu/ltu/ news/baltic-tax-rates-from-1-january-2023 accessed 10 August 2023.

47Thomas Blanchet, Lucas Chancel and Amory Gethin, ‘Why is Europe More Equal than the United States?’ (2022) 14(4) American Economic Journal: Applied Economics 480, doi: 10.1257/app.20200703.

48Elena Fernández-Rodríguez, Roberto García-Fernández and Antonio Martínez-Arias, ‘Business and Institutional Determinants of Effective Tax Rate in Emerging Economies’ (2021) 94(C) Economic Modelling 692, doi:10.1016/j.econmod.2020.02.011.

49Ioannis Stamatopoulos, Stamatina Hadjidema and Konstantinos Eleftheriou, ‘Explaining Corporate Effective Tax Rates: Evidence from Greece’ (2019) 62(C) Economic Analysis and Policy 236, doi:10.1016/j. eap.2019.03.004.

50Dong Frank Wu and Friedrich Schneider, Nonlinearity Between the Shadow Economy and Level of Development (WP/19/48, IMF 2019) doi:10.5089/9781484399613.001.

51Mykolas Navickas, Vytautas Juščius and Valentinas Navickas, ‘Determinants of Shadow Economy in Eastern European Countries’ (2019) 66(1) Scientific Annals of Economics and Business 1, doi:10.2478/ saeb-2019-0002.

52Leandro Medina and Friedrich Schneider, ‘The Evolution of Shadow Economies Through the 21st Century’ in Corinne C Delechat and Leandro Medina (eds), The Global Informal Workforce: Priorities for Inclusive Growth (IMF 2021) 11.

53Friedrich Schneider, ‘Do Different Estimation Methods Lead to Implausible Differences in the Size of Non-Observed or Shadow Economies? A Preliminary Answer’ (2021) 9434 CESifo Working Paper, doi:10.2139/ssrn.3975110.

REFERENCES

-

Achim MV and others, ‘The Shadow Economy and Culture: Evidence in European Countries’ (2019) 57(5) Eastern European Economics 352, doi:10.1080/00128775.2019.1614461.

-

Alm J, Enami A and McKee M, ‘Who Responds? Disentangling the Effects of Audits on Individual Tax Compliance Behavior’ (2020) 48(2) Atlantic Economic Journal 147, doi:10.1007/s11293-020- 09672-4.

-

Arvin MB, Pradhan RP and Nair MS, ‘Are there Links between Institutional Quality, Government Expenditure, Tax Revenue and Economic Growth? Evidence from Low-Income and Lower Middle-Income Countries’ (2021) 70(C) Economic Analysis and Policy 468, doi:10.1016/j. eap.2021.03.011.

-

Bello OI and Kasztelnik K, ‘Observational Study of Tax Compliance and Tax Evasion in Nigeria’ (2022) 6(4) Financial Markets, Institutions and Risks 1, doi:10.21272/fmir.6(4).1-14.2022.

-

Blanchet T, Chancel L and Gethin A, ‘Why is Europe More Equal than the United States?’ (2022) 14(4) American Economic Journal: Applied Economics 480, doi: 10.1257/app.20200703.

-

Dang VC, Nguyen QK and Tran XH, ‘Corruption, Institutional Quality and Shadow Economy in Asian Countries’ (2022) Applied Economics Letters, doi:10.1080/13504851.2022.2118959.

-

Solis-Garcia, M., & Xie, Y. (2018). Measuring the size of the shadow economy using a dynamic general equilibrium model with trends. Journal of Macroeconomics, 56, 258-275. https://doi. org/10.1016/j.jmacro.2018.04.004

-

Fedajev A and others, ‘Factors of the Shadow Economy in Market and Transition Economies During the Post-Crisis Period: Is There a Difference?’ (2022) 33(3) Inžinerinė Ekonomika 246, doi:10.5755/j01.ee.33.3.28417.

-

Feige EL, ‘A Re-Examination of the “Underground Economy” in the United States: A Comment on Tanzi’ (1986) 33(4) IMF Staff Papers 768, doi:10.2307/3867216.

-

Feige EL, ‘How Big is the Irregular Economy?’ (1979) 22(5) Challenge 5, doi:10.1080/05775132. 1979.11470559.

-

Feld LP and Schneider FG, ‘Survey on the Shadow Economy and Undeclared Earnings in OECD Countries’ (2010) 11(2) German Economic Review 109, doi:10.1111/j.1468-0475.2010.00509.x.

-

Fernández-Rodríguez E, García-Fernández R and Martínez-Arias A, ‘Business and Institutional Determinants of Effective Tax Rate in Emerging Economies’ (2021) 94(C) Economic Modelling 692, doi:10.1016/j.econmod.2020.02.011.

-

Gharleghi B and Jahanshahi AA, ‘The Shadow Economy and Sustainable Development: The Role of Financial Development’ (2020) 20(3) Journal of Public Affairs e2099, doi:10.1002/pa.2099.

-

Ginevicius R and others, ‘The Impact of National Economic Development on the Shadow Economy’ (2020) 12(4) Journal of Competitiveness 39, doi:10.7441/joc.2020.04.03.

-

Gokmenoglu KK and Amir A, ‘Investigating the Determinants of the Shadow Economy: The Baltic Region’ (2023) 61(2) Eastern European Economics 181, doi:10.1080/00128775.2022.2163905.

-

. Huynh CM and Nguyen TL, ‘Fiscal Policy and Shadow Economy in Asian Developing Countries: Does Corruption Matter?’ (2020) 59(4) Empirical Economics 1745, doi:10.1007/s00181-019- 01700-w.

-

Janský P and Palanský M, ‘Estimating the Scale of Profit Shifting and Tax Revenue Losses Related to Foreign Direct Investment’ (2019) 26 International Tax and Public Finance 1048, doi:10.1007/ s10797-019-09547-8.

-

Karolak A, ‘Adaptation Process of a Polish Tax Law to European Union Norms — Harmonization of a Value Added Tax’ (2011) 4(1) Economics and Sociology 54, doi:10.14254/2071- 789X.2011/4-1/6.

-

Kaufmann D and Kaliberda A, Integrating the Unofficial Economy into the Dynamics of Post Socialist Economies: A Framework of Analysis and Evidence (Policy Research Working Paper 1691, World Bank 1996) doi:10.1596/1813-9450-1691.

-

. Kelmanson B and others, Explaining the Shadow Economy in Europe: Size, Causes And Policy Options (WP/19/278, IMF 2019) doi:10.5089/9781513520698.001.

-

Khuong NV and others, ‘Does Corporate Tax Avoidance Explain Cash Holdings? The Case of Vietnam’ (2019) 12(2) Economics and Sociology 79, doi:10.14254/2071-789X.2019/12-2/5.

-

. Kirchner S and Schüßler E, ‘Regulating the Sharing Economy: A Field Perspective’ in Maurer I, Mair J and Oberg A (eds), Theorizing the Sharing Economy: Variety and Trajectories of New Forms of Organizing (Research in the Sociology of Organizations 66, Emerald Pub 2020) 215, doi:10.1108/S0733-558X20200000066010.

-

Klemm AD and others, Are Elasticities of Taxable Income Rising? (WP/18/132, IMF 2018) doi:10.5089/9781484361566.001.

-

Liakhovets O, ‘Tax Incentives Effectiveness for the Innovation Activity of Industrial Enterprises in Ukraine’ (2014) 7(1) Economics and Sociology 72, doi:10.14254/2071-789X.2014/7-1/7.

-

S. Lorenz N and Sachs D, ‘Identifying Laffer Bounds: A Sufficient‐Statistics Approach with an Application to Germany’ (2016) 118(4) Scandinavian Journal of Economics 646, doi: 10.1111/ sjoe.12170.

-

Medina L and Schneider F, ‘The Evolution of Shadow Economies Through the 21st Century’ in Delechat CC and Medina L (eds), The Global Informal Workforce: Priorities for Inclusive Growth (IMF 2021) 11.

-

Medina L and Schneider F, Shadow Economies Around the World: What Did We Learn Over the Last 20 Years? (WP/18/17, IMF 2018) doi:10.5089/9781484338636.001.

-

Medina L and Schneider FG, ‘Shedding Light on the Shadow Economy: A Global Database and the Interaction with the Official One’ (2019) 7981 CESifo Working Paper, doi:10.2139/ ssrn.3502028.

-

Mishchuk H and others, ‘Impact of the Shadow Economy on Social Safety: The Experience of Ukraine’ (2020) 13(2) Economics and Sociology 289, doi:10.14254/2071-789X.2020/13-2/19.

-

Nadirov O, Dehning B and Pavelkova D, ‘Taxes and the Incentive to Work under Flat and Progressive Tax Systems in Slovakia’ (2021) 14(2) Economics and Sociology 40, doi:10.14254/2071- 789X.2021/14-2/2.

-

Navickas M, Juščius V and Navickas V, ‘Determinants of Shadow Economy in Eastern European Countries’ (2019) 66(1) Scientific Annals of Economics and Business 1, doi:10.2478/saeb-2019-0002.

-

Němec D and others, ‘Corruption, Taxation and the Impact on the Shadow Economy’ (2021) 9(1) Economies 18, doi:10.3390/economies9010018.

-

Ohnsorge F and Yu S (eds), The Long Shadow of Informality: Challenges and Policies (World Bank Pub 2022).

-

Oliveira FG de and Costa L, ‘The VAT Laffer Curve and the Business Cycle in the EU27: An Empirical Approach’ (2015) 20(2) Economic Issues 29.

-

Prichard W and others, Innovations in Tax Compliance: Conceptual Framework (Policy Research Working Paper 9032, World Bank 2019).

-

Rabbi F and Almutairi SS, ‘Corporate tax avoidance practices of multinationals and country responses to improve quality of compliance’ (2021) 15(1) International Journal for Quality Research 21, doi:10.24874/IJQR15.01-02.

-

Samoilikova A, ‘Financial Policy of Innovation Development Providing: The Impact Formalization’ (2020) 4(2) Financial Markets, Institutions and Risks 5, doi:10.21272/fmir.4(2).5-15.2020.

-

Schneider F and Buehn A, ‘Shadow Economy: Estimation Methods, Problems, Results and Open questions’ (2018) 1(1) Open Economics 1, doi:10.1515/openec-2017-0001.

-

Schneider F, ‘Do Different Estimation Methods Lead to Implausible Differences in the Size of Non-Observed or Shadow Economies? A Preliminary Answer’ (2021) 9434 CESifo Working Paper, doi:10.2139/ssrn.3975110.

-

Schneider F, ‘New COVID-Related Results for Estimating the Shadow Economy in the Global Economy in 2021 and 2022’ (2022) 19(2) International Economics and Economic Policy 299, doi:10.1007/s10368-022-00537-6.

-

Schneider FG and Enste DH, Hiding in the Shadows: The Growth of the Underground Economy (Economic Iss 30, IMF 2002).

-

Sokolovska A and others, ‘The Impact of Globalization and International Tax Competition on Tax Policies’ (2020) 11(4) Research in World Economy 1, doi:10.5430/rwe.v11n4p1.

-

Stamatopoulos I, Hadjidema S and Eleftheriou K, ‘Explaining Corporate Effective Tax Rates: Evidence from Greece’ (2019) 62(C) Economic Analysis and Policy 236, doi:10.1016/j. eap.2019.03.004.

-

Temple AJ and others, ‘Illegal, Unregulated and Unreported Fishing Impacts: A Systematic Review of Evidence and Proposed Future Agenda’ (2022) 139(3) Marine Policy 105033, doi:10.1016/j.marpol.2022.105033.

-

Ulvidienė E and others, ‘An Investigation of the Influence of Economic Growth on Taxes in Lithuania’ (2023) 102(1) Ekonomika 41, doi: 10.15388/Ekon.2023.102.1.3.

-

Ulvidienė E and others, ‘The Relationship between GDP and Tax Revenues from the Market of Gambling and Lotteries in Lithuania’ (2023) 1(222) Bulletin of Taras Shevchenko National University of Kyiv, Economics, doi:10.17721/1728-2667.2023/222-1/19.

-

Williams CC and Schneider F, Measuring the Global Shadow Economy: The Prevalence of Informal Work and Labour (Edward Elgar Pub 2016) doi:10.4337/9781784717995.

-

Wu DF and Schneider F, Nonlinearity Between the Shadow Economy and Level of Development (WP/19/48, IMF 2019) doi:10.5089/9781484399613.001.

Authors information

Vincentas Rolandas Giedraitis

Dr., Prof., Department of theoretical economics, Faculty of Economics and Business administration, Vilnius University, Lithuania vincas.giedraitis@evaf.vu.lt https://orcid.org/0000-0002-0293-0645 Corresponding author, responsible for writing, for ensuring that the descriptions and the manuscript are accurate and agreed by all authors. Disclaimer: The authors declare that their opinion and views expressed in this manuscript are free of any impact of any organizations.

Andriy Stavytskyy

Dr. Sc. (Economic), Prof., Faculty of Economics, Taras Shevchenko National University of Kyiv, Ukraine a.stavytskyy@gmail.com, https://orcid.org/0000-0002-5645-6758 Co-author, responsible for methodology and results.

Ganna Kharlamova

Dr. Sc. (Economic), Prof., Faculty of Economics, Taras Shevchenko National University of Kyiv, Kyiv, Ukraine ganna.kharlamova@knu.ua https://orcid.org/0000-0003-3614-712X Co-author, responsible for literature review and results. Competing interests: Dr Ganna Kharlamova serves as a Managing Editor in AJEE, nevertheless, this contribution passed through the publishing process properly. The author is not bound by her service and has declared that no conflict of interest or competing interests exist.

Erstida Ulvidienė

Assoc. Prof. Faculty of Economics and Business administration, Vilnius University, Lithuania erstida.ulvidiene@ evaf.vu.lt https://orcid.org/0000-0003-2172-465X Co-author, responsible for literature review and results.

Managing editor – Prof. Iryna Izarova

English Editor – Julie Bold.

About this article

Submitted on 21 Jul 2023 / Revised 21 Aug 2023 / Approved 5 Sep 2023

Published online: 20 Oct 2023

Summary: 1. Introduction. — 2. Literature review. — 3. Methodology. — 4. Data. — 5. Results. – 6. Limitations of the study. — 7. Conclusions. — 8. Discussion & Legal aspects.

Keywords: Shadow Economy, Economic Growth, Panel Regression Model, Tax Revenue, Effective Tax Rate, Baltic States

Rights and Permissions

Copyright:© 2023 V Giedraitis, A Stavytskyy, G Kharlamova, E Ulvidienė. This is an open access article distributed under the terms of the Creative Commons Attribution License, (CC BY 4.0), which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.