Summary: 1. Introduction. – 2. Methodology. – 3. Results. – 4. Discussion. – 5. Conclusions.

ABSTRACT

Background:Mandatory application of IFRS for a specified list of entities brings about additional costs in terms of material, financial and labour resources. Consequently, this encourages the search for ways to minimise costs related to the transition to IFRS adoption, that is, its formalisation. Under such conditions, the need to improve the methodological toolkit for evaluating the process of transformation of financial statements in accordance with the requirements of the IFRS is actualised. This article aims to develop a methodological toolkit for assessing the quality of the financial reporting transformation process per IFRS requirements, using Ukrainian dairy industry enterprises as a case study

Methods:The assessment of the impact of the transition to IFRS reporting on changes in the financial status of entities was carried out using statistical methods of comparison, generalisation, grouping, and coefficients. Conclusions were drawn based on the research findings employing the method of logical generalisation

Results and conclusions:The method of assessing the impact of the application of IFRS on the financial condition of enterprises in the dairy industry of Ukraine has been improved, particularly in terms of accounting for changes in financial statements as a result of transformational adjustments before and after the date of transition to IFRS. This refinement involves employing financial coefficients as a means of assessment, facilitating the determination of the quality assessment of the process of drawing up the first financial statements of enterprises in accordance with IFRS.

New methodological aspects and recommendations for assessing the quality of the transformation process in the context of the application of IFRS will ensure effective management of enterprises in the dairy industry of Ukraine, leading to an increase in the attraction of foreign investments amidst the conditions of European integration processes and the post-war period.

1 INTRODUCTION

The financial reporting of entities and the quality of accounting information in the context of the application of International Financial Reporting Standards (IFRS) must be considered special objects of internal control since preparing the first financial reporting under IFRS and subsequently reflecting economic transactions and processes in accounting; there is a high level of subjectivity due to the application of professional judgment, changes in accounting policies and estimates, the choice of different methods of transformation of financial reporting when transitioning from the application of National Accounting Standards to IFRS.

The general recognition and adoption of International Standards of Financial Reporting (IFRS) as the new global standards and framework for financial reporting has been hailed as one of the biggest revolutions in the accounting profession.

Scientific research on the problems of adaptation and application of IFRS in different countries was carried out by many scientists.1

Psaros J. and Trotman K. argued that using a single accounting standard is expected to improve the quality of financial reporting. According to the IFRS Concept of the International Accounting Standards Board, qualitative characteristics make the information provided in financial statements helpful to others.2

Tendeloo and Vanstraelen in their study of IFRS adoption for German companies, found that companies adopting IFRS do not exhibit better earnings management behaviour than companies reporting under German GAAP standards. In other words, their findings indicate that the voluntary application of IFRS in Germany cannot be associated with less earnings management.3

Barth et al. believed that IFRS encourages managers to be creative and use professional judgment, which tends to reduce the comparability, transparency, relevance, and reliability of financial information and, therefore, negatively impacts the quality of financial reporting.4

Iatridis investigated the potential of earnings management by examining the company’s accounting indicators reported under GAAP and IFRS using the ordinary least squares regression technique.5 The scientific work found that implementing IFRS reduces the scope of earnings management, leading to a higher cost of related accounting measures. This suggests that less information and earnings manipulation will lead to the disclosure of higher-quality accounting information and help investors make informed and unbiased judgments.

Liu C., Yao L., Hu N., Liu L. investigated the impact of IFRS on accounting quality in China using earnings management and value relevance as indicators of accounting quality. The scholars conducted evaluations by combining pre- and post-IFRS observations to determine the possible impact of IFRS adoption on the accounting quality of Chinese companies.6

Uyar conducted a study on the impact of standard change on accounting quality in Turkey using earnings management, timely recognition of losses, and cost relevance indicators. The scientific study revealed an enhancement in the accounting quality, particularly as the market became more active.7

Palea underscores the importance of assessing how accounting regulations can affect the quality of financial reporting. This assessment holds significant implications for standardsetting purposes, given the widespread adoption of IFRS in diverse countries worldwide and the anticipation of many other countries adopting it in the near future.8

Piechocka-Kaluzna investigated the quality of financial reporting of entities prepared under IFRS, which previously used Polish GAAP. The study concluded that implementing IFRS as a basis for preparing financial statements improves the quality of accounting.9

Furthermore, many Ukrainian researchers devoted their scientific works to the issue of adapting the national accounting and reporting system to the requirements of IFRS through standardisation and harmonisation.10

Zhuravka substantiates the expediency of implementing international financial reporting standards in Ukraine. The author examines the prospects of using IFRS in national accounting practice, defines the principle of transformation as a priority, and identifies the stages of IFRS implementation in Ukraine and the problems that arise at each stage. In addition to addressing the shortcomings of reforming the national accounting system, the author presents ways to optimise the process of IFRS implementation in Ukraine.11

Shulga, Tovkun, Perepelitsa, and Duravkin analysed problematic issues related to adapting Ukraine’s national accounting and financial reporting system to IFRS. Their research systematised the advantages and challenges of this process and also noted that the success of IFRS adaptation in Ukraine depends on balanced, coordinated actions of state administration bodies, professional organisations and entities.12

In summary, it can be concluded that in scientific works, such issues are highlighted as the fact that the historical national features and the specifics of certain branches of the economy of different countries, in particular Ukraine, are not taken into account when approaching the harmonisation and standardisation of the accounting system on a global scale.

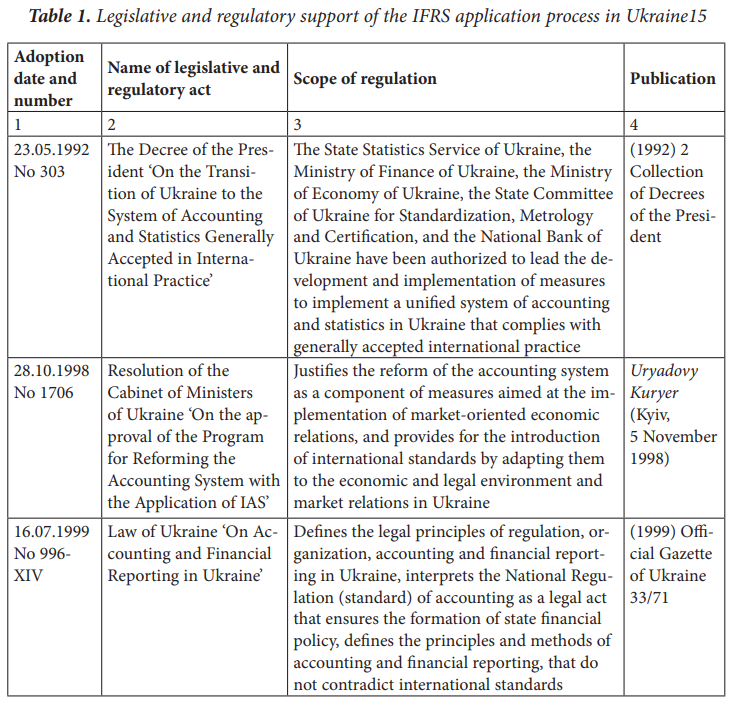

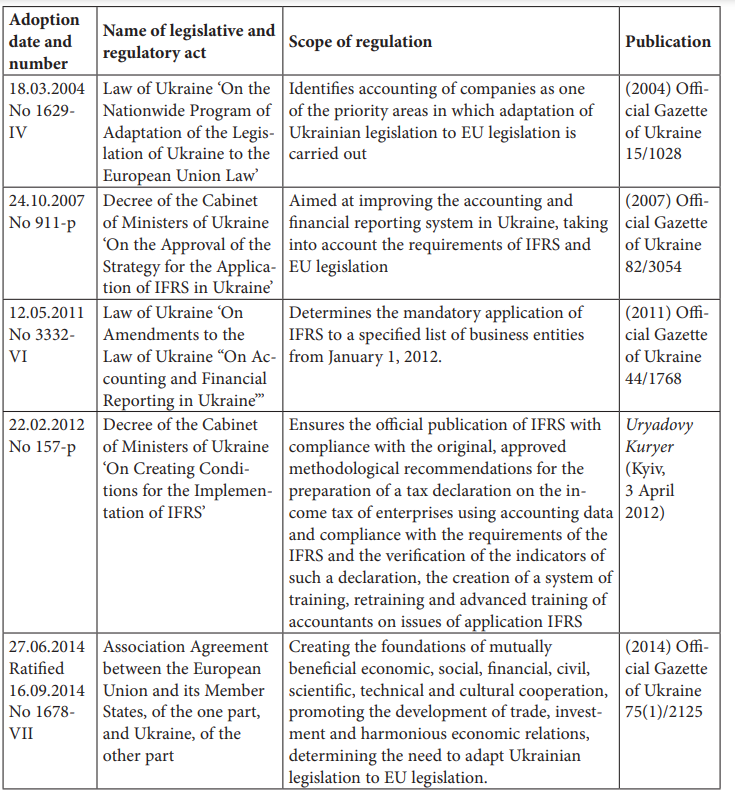

The process of applying IFRS in Ukraine in the development of legislative and regulatory support for accounting and reporting was started in 1998, when the resolution of the Cabinet of Ministers of Ukraine dated October 28, 1998 No 1706 approved the Program for reforming the accounting system with the application of international standards.13 The Decree of the President of Ukraine, dated May 23, 1992, was the first legislative act defining the prerequisites for applying IFRS in Ukraine ‘On the transition of Ukraine to the system of accounting and statistics generally accepted in international practice’.14 Since then, several normative documents have been adopted in Ukraine, which regulate the application of IFRS and contain various clarifications for companies, auditing firms, and controlling and coordinating state authorities (Table 1).15

Thus, from January 1, 2018, by the Law of Ukraine ‘On Accounting and Financial Reporting in Ukraine’,16 enterprises of public interest, public joint-stock companies, business entities operating in the extractive industries, parent enterprises of groups, which include enterprises of public interest, parent enterprises of a large group that do not belong to the category of large enterprises, as well as enterprises that conduct economic activities according to the types, the list of which is determined by the Cabinet of Ministers of Ukraine. This mandate dictates that these entities must prepare financial statements and consolidated financial reporting according to international standards.

2 METHODOLOGY

Retrospective adjustments related to a change in accounting policy when transitioning to IFRS must be attributed directly to retained earnings on the transition date to IFRS or another item of equity. Such adjustment procedures at the first preparation of financial statements under IFRS17 will affect the structure, ratio and size of assets, liabilities, income, expenses, and elements of capital. Accordingly, the transition to drawing up financial statements according to IFRS will lead to changes in the indicators of the financial condition of enterprises in the dairy industry of Ukraine. As a result of transformational adjustments of financial reporting items and possible changes in accounting policies or accounting estimates by the requirements of individual standards, there is a possibility that the indicators of the financial condition of enterprises will be different before the date of the first application of IFRS and after this date.

The research hypothesis posits that the change in indicators of the financial condition of enterprises, driven by the need for reclassification and retrospective adjustments of financial reporting items when switching to the application of IFRS, characterises the systematic approach to the transformation of reporting under IFRS and contributes to the improvement of the quality of accounting information. Methodical regulations for evaluating the process of the initial IFRS application of IFRS, which is based on the determination of changes in the values of financial reporting indicators as a result of transformational adjustments before and after the date of transition to IFRS using the method of financial ratios, make it possible to determine the level of systematicity or formality in the preparation of the first financial statements of enterprises per IFRS. To investigate the hypothesis, the quality of the process of transformation of financial reporting of enterprises in the dairy industry of Ukraine was evaluated following the requirements of IFRS. Based on the results of such an assessment, it was concluded how prepared and responsible the enterprises were in preparing the first IFRS reporting.

To assess the quality of the process of transformation of financial reporting of enterprises according to IFRS, twenty joint-stock companies of the dairy industry located in different regions of Ukraine were selected. The official financial statements of these enterprises, posted on the website of the National Securities and Stock Market Commission of Ukraine18, became the information base for the impact of the transition to IFRS on the financial status. Also, an essential factor in the selection of enterprises of the dairy industry for the assessment of the quality of the transformation of financial statements was the fact that a significant number of enterprises representing this industry are joint-stock companies, which, according to the requirements of national legislation, are obliged to switch to the formation of financial statements as per IFRS.

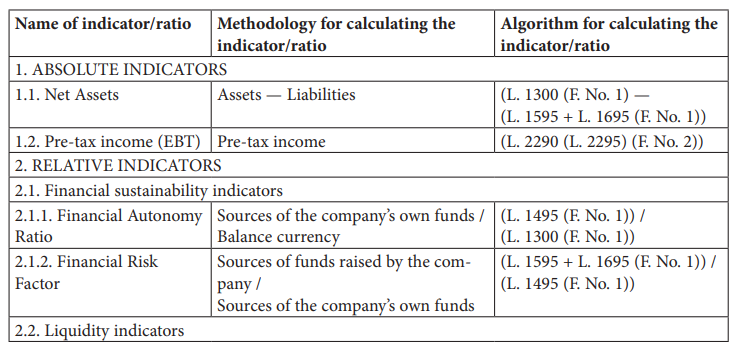

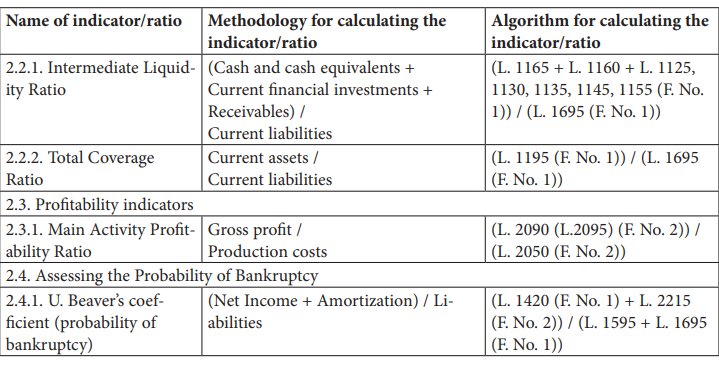

To assess the quality of the transformation process of financial reporting following IFRS, the ratio method was used to determine the rate of change of individual financial ratios before and after the transition date to IFRS application when preparing financial statements. In particular, the research used absolute and relative indicators covering a comprehensive range of critical financial condition characteristics traditionally used in practice. The following are the fundamental indicators:

- the net assets indicator, which makes it possible to comprehensively assess changes in assets, capital and liabilities of the enterprise;

- an indicator of pre-tax income (EBT) to assess changes in the financial result of activity. The selection of this indicator is justified by its characteristics as a performance indicator of the activity of each business entity, which is controlled by management.

To assess the impact of the application of IFRS on the financial position in terms of relative indicators, the following is proposed:

- Financial Autonomy Ratio and Financial Risk Factor — to assess the economic sustainability of the company;

- Intermediate Liquidity Ratio and Total Coverage Ratio — to determine the company’s liquidity;

- The Main Activity Profitability Ratio is basic in the formation of the central part of the enterprise’s profit (loss);

- Beaver’s coefficient to assess the probability of bankruptcy. The choice of Beaver’s coefficient is justified by the approbation and interpretation of its values based on the information of business entities that belong to the continental accounting model.

Also, to ensure the principle of comparison of indicators of financial analysis, it is necessary to clarify the methodology of calculating each coefficient when changing the content of financial reporting forms as the primary source of research, based on which the assessment of the financial condition is carried out.

Considering that in 2013, changes were made to the National Regulation (Standard) of Accounting No. 1 ‘General requirements for financial reporting’19 in terms of the content of sections and articles of financial reporting forms, Table 2 shows the algorithm for calculating indicators (coefficients) to and after appropriate changes.

Table 2. The system of indicators (ratios) and their calculation method for assessing the financial condition of enterprises (L. — financial statement line; F. No. 1 — Financial reporting form No. 1 ‘Statement of Financial Position’ (Balance sheet); F. No. 2 — Financial reporting form No. 2 ‘Profit and Loss Statement and other comprehensive income’)20

3 RESULTS

The change in net assets in absolute indicators illustrates an extraordinary trend. Only PrJSC Bershadmilk and JSC Zhytomyr Butter Plant show positive net asset changes. There is a slight decrease in net assets for PJSC Zhashkiv Dairy Plant. In contrast, PJSC Svitlovodsky BCMP demonstrates a significant decrease in net assets after applying IFRS, signalling changes in the composition of support and/or liabilities, influencing the net assets indicator.

According to the analysis results, the rate of change in the amount of assets deviates from unity in merely ten enterprises, which is 33% of the total number of enterprises. For the remaining enterprises (67%), the rate of change is equal to one. Therefore, any transformational adjustments in the composition of assets during the transition to IFRS were not made.

The assessment of the rate of change in the number of liabilities shows that four enterprises (PrJSC Wimm-Bill-Dann Ukraine, PJSC Chernihiv Milk Factory, JSC Zhytomyr Butter Plant, PJSC Svitlovodsky BCMP) made significant adjustments to the liability post-IFRS transition. Such adjustments were insignificant or absent for the rest of the enterprises.

The assessment in the pre-tax profit indicator of the enterprises made it possible to determine the facts of reclassifications in items of income and expenses, or items of assets and liabilities, which can affect income and expenses, and in the end — the amount of equity (net assets, due to the adjustment of net profit).

The profit and loss statement, which displays information for the reporting period, was used to sample data for estimating profit before taxation. This made it possible to display the absolute indicators of the profit of enterprises, calculated according to National Accounting Standards, as well as at the beginning of the first reporting period according to IFRS, taking into account retrospective adjustments of assets and liabilities. The results of the analysis confirm that in the reporting of PJSC Chernihiv Milk Factory, PrJSC Bershadmilk, JSC Zhytomyr Butter Plant and PJSC Svitlovodsky BCMP, there are significant differences between the pre-tax profit indicators after retrospective adjustment of items. In particular, the profit indicator was affected by the operations of bringing fixed assets to fair value, the display of new objects of non-current assets in accordance with the criteria for their recognition in IFRS, as well as the change in costs in connection with the adjustment of the amount of depreciation for such objects.

According to the assessment results of the rate of change of the pre-tax profit indicator, significant changes related to the transition to the application of IFRS were also revealed. In particular, the rate of change in pre-tax profit is zero for PrJSC Zarichnenny Milk Factory, PrJSC Novovodolazh Milk Factory, PJSC Chernihiv Milk Factory, PJSC Khrystynivsky Milk Factory, PrJSC Bershadmilk and PJSC Svitlovodsky BCMP. This result is due to the reflection in the profit and loss statement of the zero value of pre-tax profit, which does not meet the requirements of IFRS. Conversely, for the remaining enterprises, constituting 70% of the total population, the rate of change in profit before taxation is equal to one. This indicates the absence of any retrospective adjustments in the composition of income and expenses for the reporting period preceding the first financial reporting period under IFRS.

Significant deviations of the autonomy coefficient values are observed, particularly at PJSC Khrystynivsky Milk Factory, PJSC Shpolyansk Milk Factory, PJSC Zhashkiv Dairy Plant and PJSC Horodyshchen Butter Plant. Factors influencing such a result in a downward direction after the transition to IFRS include the appropriate adjustment of assets and liabilities that do not affect the change in the amount of equity capital. Recommended values for the coefficient of autonomy are traditionally defined at the level of 0.5 — minimum and 0.8 — maximum. Based on this, the calculation of the coefficient of autonomy before and after the application of IFRS showed that the value of the indicators of fifteen enterprises (75%) is below the minimum level. At PrJSC Bershadmilk, JSC Zhytomyr Butter Plant, PrJSC Kalanchat Butter Plant and PJSC Kherson Butter Plant, the value of the coefficient is within the defined level, and only at PrJSC Chortkiv Cheese Factory the autonomy coefficient is higher than the maximum value.

According to the results of the analysis of the coefficient of autonomy, it can be concluded that the transition to the application of IFRS for enterprises of the milk processing industry of Ukraine did not significantly affect the change in their autonomy since no significant fluctuations in the values of the indicator were recorded.

To evaluate the liquidity of enterprises, intermediate liquidity ratios and the total coverage ratio were calculated both before and after the date of application of IFRS. Based on these indicators, the impact of adjustments to the value of financial investments, receivables and payables, and current assets in general was estimated. Analysis of the intermediate liquidity ratio indicates the absence of adjustments to the value of financial instruments, as notable deviations in ratio values were primarily observed at JSC Zhytomyr Butter Plant and PJSC Svitlovodsky BCMP. In contrast, the calculation of the total coverage ratio indicates significant changes in the adjustment of specific components such as current assets, costs of future periods, and current liabilities

To justify the results of the analysis of the overall coverage ratio, it is advisable to determine the normative values directly for enterprises of the processing industry with a short operating cycle at the level of:

- 1.25 — the minimum (the value of the coefficient below the minimum indicates insufficient short-term solvency and decapitalisation of the enterprise);

- 2 — the maximum (exceeding the value of the coefficient of the maximum is an indicator of inefficient management of current assets).

The analysis results showed significant deviations in values, with a general trend of a decrease in the total coverage ratio after the application of IFRS.

Calculating the profitability ratio of the main activity will make it possible to analyse the application of retrospective adjustments in the composition of the enterprise articles, impacting gross profit and production costs. Key factors affecting the gross profit indicator include the volume of products sold in the assortment, product pricing, and production costs.

According to the results, the gross profit growth rate indicates the implementation of retrospective adjustments at JSC Zhytomyr Butter Plant and PrJSC Kalanchat Butter Plant. Based on the assessment of the growth rate of production costs, it can be concluded that the change in the amount of gross profit is due to the change in the volume of production costs at the respective enterprises.

Of the analysed enterprises, seven (35%) showed zero indicators of gross profit and production costs based on the results of the reporting period preceding the first year of preparing financial statements under IFRS; the remaining enterprises did not make any retrospective adjustments since the growth rate is equal to one.

Based on a comparative analysis of the values of the profitability ratio of the main activity of enterprises before and after the application of IFRS, the following generalisations were made:

- seven enterprises (35%) did not make retrospective adjustments, and the deviation of the profitability ratio is explained by zero indicators of gross profit and production costs for the last reporting period before the application of IFRS;

- six enterprises (30%) made retrospective adjustments on the date of application of IFRS, but the absolute value of such adjustments is insignificant;

- seven enterprises (30%) did not make retrospective adjustments during the transition to the application of IFRS, which does not meet the requirements of IFRS

The impact of the IFRS application for the formation of financial statements on the probability of bankruptcy of enterprises was assessed using the Beaver ratio coefficient, calculated by incorporating indicators like net profit, amortisation of non-current assets, and liabilities. Such articles, upon first application of IFRS, are also subject to retrospective adjustments, which may increase or decrease the probability of enterprise bankruptcy. Thus, in assessing the net profit of enterprises on the date of transition to IFRS, only twelve enterprises (60%) made a retrospective adjustment of items that affected the change of this indicator. It should also be noted that six enterprises (30%) reflected in their financial statements the change in the amount of depreciation of non-current assets as of the date of application of IFRS. The factor that influenced the adjustment of the amount of depreciation is the revaluation of noncurrent assets in connection with revised accounting policies aligned with IFRS requirements.

To assess the process of forming the first financial statements according to IFRS by enterprises, the presence of reclassification and retrospective adjustments of individual items and their impact on the quality of accounting information, the following criteria are proposed:

- changes in 2/3 or more of the indicators– a quality process of preparation for the first application of IFRS;

- changes in 1/3 or more of the indicators — formal preparation for the first application of IFRS;

- no changes — non-compliance of financial statements with IFRS requirements.

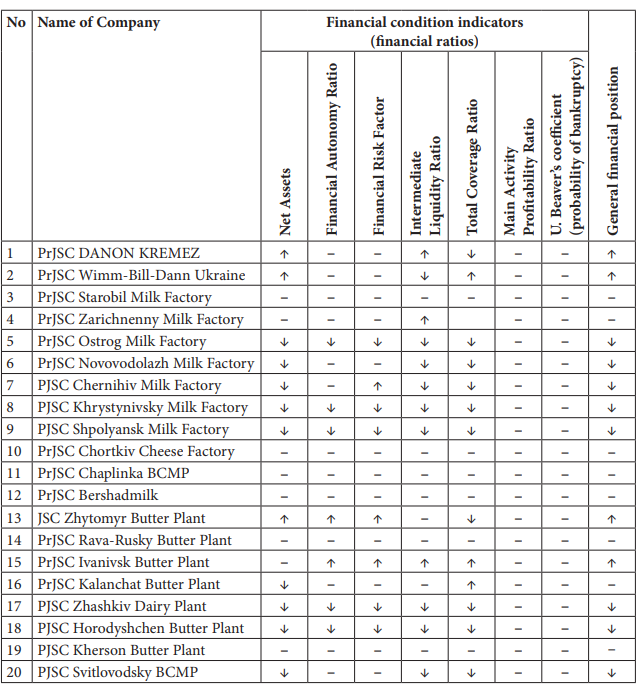

The general results of assessing the impact of the application of IFRS on the financial condition of enterprises, based on the analysis of determined financial ratios, are shown in Тable 3.

Table 3. The changes of the financial condition indicators (financial ratios) of enterprises (↑ — positive change; ↓ — negative change; – — no change)21

4 DISCUSSION

In today’s context, there exists no viable alternative to adopting IFRS for forming financial statements by companies aiming to enter international capital markets.

The Law of Ukraine ‘On Accounting and Financial Reporting in Ukraine’ defines a clear list of business entities that are required to prepare financial statements in accordance with IFRS. This encompasses entities of public interest, public joint-stock companies, business entities that carry out activities in extractive industries, parent enterprises of groups, which include enterprises of public interest, parent enterprises of a large group that do not belong to the category of large enterprises, as well as enterprises that conduct economic activities by types, as determined by the Cabinet of Ministers of Ukraine.

Within this list, the requirement for public joint-stock companies to adhere to IFRS causes the most considerable debate. Such entities are not always of public interest and may not belong to the category of large enterprises.

Additionally, examining the case of the Ukrainian dairy industry highlights that not all public joint-stock companies pursue international stock markets to secure foreign investments.

Therefore, taking into account the above, further scientific discussion should provide an answer to the question of whether there really is a need for mandatory application of IFRS for all public joint-stock companies.

5 CONCLUSIONS

In accordance with the defined criteria and the results of the impact assessment of IFRS’ application on individual categories of financial statements, the distribution of enterprises based on the quality of preparation of the first financial statements are as follows:

- Inconsistency of financial reporting with IFRS requirements — 16%;

- The formal transformation of articles — 20%;

- Qualitative transformation of articles — 64%

The results of the quality assessment of the transformation process of financial statements to comply with IFRS, based on an analysis of the financial state of enterprises, can be considered reasonable and reliable. This assertion is well-founded since the research process covered a significant list of financial statement elements, namely assets, in particular, current assets, cash and their equivalents, current financial investments, current receivables; equity, longterm liabilities; current liabilities; gross profit; profit before taxation; net profit; amortisation; production costs.

In conclusion, it is appropriate to assume that enterprises whose financial condition did not change after the transition to accounting and financial reporting to IFRS-compliant accounting and financial reporting have formally approached transformational adjustments and the application of conceptual principles in forming financial statements that align with the standards set forth by IFRS.

1Karthik Ramanna and Ewa Sletten, Why Do Countries Adopt International Financial Reporting Standards? (Working Papers 09-102, Harvard Business School 2009); Anna Alon, ‘The IFRS Question: To Adopt or Not?’ in D Feldmann and TJ Rupert (eds), Advances in Accounting Education: Teaching and Curriculum Innovations (Advances in Accounting Education vol 13, Emerald Group Publishing Limited 2012) 405, doi:10.1108/S1085-4622(2012)0000013021; Victor-Octavian Müller, ‘The Impact of IFRS Adoption on the Quality of Consolidated Financial Reporting’ (2014) 109 Procedia Economics and Finance 976, doi:10.1016/j.sbspro.2013.12.574; Ray Ball, Xi Li and Lakshmanan Shivakumar, ‘Contractibility and Transparency of Financial Statement Information Prepared under IFRS: Evidence from Debt Contracts around IFRS Adoption’ (2015) 53(5) Journal of Accounting Research 915, doi:10.1111/1475-679X.12095; Irina-Doina Păşcan, ‘Measuring the Effects of IFRS Adoption on Accounting Quality: A Review’ (2015) 32 Procedia Economics and Finance 580, doi:10.1016/S2212-5671(15)01435-5; David Procházka, ‘The Development of Capital Markets of New EU Countries in the IFRS Era’ (2015) 25 Procedia Economics and Finance 116, doi:10.1016/S2212-5671(15)00720-0; Lucie Vallišová and Lilia Dvořáková, ‘Implementation of International Financial Accounting Standards from the Perspective of Companies in the Czech Republic’ (2018) 167(9-10) Economic Annals-XXI 70, doi:10.21003/ea.V167-14.

2Jim Psaros and Ken T Trotman, ‘The Impact of the Type of Accounting Standards on Preparers Judgments’ (2004). 40(1) Abacus 76, doi:10.1111/j.1467-6281.2004.00144.x.

3 Brenda van Tendeloo and Ann Vanstraelen, ‘Earnings Management under German GAAP Versus IFRS’ (2005) 14(1) European Accounting Review 155, doi:10.1080/0963818042000338988.

4Mary E Barth and others, Accounting Quality: International Accounting Standards and US GAAP (Working paper series, Stanford University and University of North Carolina 2006).

5George Iatridis, ‘International Financial Reporting Standards and the QUality of Financial Statement Information’ (2010) 19(3) International Review of Financial Analysis 193, doi:10.1016/j.irfa.2010.02.004.

6Chunhui Liu and others, ‘The Impact of IFRS on Accounting Quality in a Regulated Market: An Empirical Study of China’ (2011) 26(4) Journal of Accounting, Auditing & Finance 659, doi:10.1177/0148558X11409164.

7Metin Uyar, ‘The Impact of Switching Standard on Accounting Quality’ (2013) 9(4) Journal of Modern Accounting and Auditing 459.

8Vera Palea, ‘IAS/IFRS and Financial Reporting Quality: Lessons from the European Experience’ (2013) 6(4) China Journal of Accounting Research 247, doi:10.1016/j.cjar.2013.08.003.

9Agnieszka Piechocka-Kaluzna, ‘Measuring The Quality of Financial Statements After the Conversion to IFRS, Case of Poland’ [2021] Journal of Financial Studies and Research 479868, doi:10.5171/2021.479868.

10RV Kuzina, ‘Harmonization of Financial Reporting: International Experience and Ukrainian Practice’ (2012) 721 Bulletin of the National University “Lviv Polytechnic” 126; Lіudmyla Lovinska, ‘The Impact of European Integration Processes on the Development of Accounting and Reporting in Ukraine’ (2014) 9 Finance of Ukraine 21; Olena Kharlamova, ‘Crisis “Markers” in the Controlling System of IFRSReporting Preparation’ (2015) 3-4(2) Economic Annals-XXI 71; Victor Shvets, ‘On the Issue of Legal and Regulatory Provision of Accounting and Financial Reporting under IFRS’ (2015) 10(175) Bulletin of the Taras Shevchenko National University of Kyiv, Economics 60.

11Fedir Zhuravka, ‘Problem aspects of transformation in financial reporting of business entities in Ukraine’ (2017) 1(1) Geopolitics under Globalization 36, doi:10.21511/gg.01(1).2017.05.

12Tetyana Shulga and others, ‘Introduction of International Financial Reporting Standards in Ukraine: Problems and Prospects’ (2019) 8(21) Amazonia Investiga 341.

13Resolution of the Cabinet of Ministers of Ukraine No 1706 ‘On Approval of the Program for Reforming the Accounting System with the Application of International Standards’ of 28 October 1998 https:// zakon.rada.gov.ua/laws/show/1706-98-%D0%BF#Text accessed 29 June 2023.

14Decree of the President of Ukraine No 303 ‘On the Transition of Ukraine to the System of Accounting and Statistics Generally Accepted in International Practice’ of 23 May 1992 (as amended of 18 April 2011) https://zakon.rada.gov.ua/laws/show/303/92#Text accessed 29 June 2023.

15Compiled by the authors

16Law of Ukraine No 996-XIV ‘On Accounting and Financial Reporting in Ukraine’ of 16 July 1999 (as amended of 10 August 2022) https://zakon.rada.gov.ua/laws/show/996-14#Text accessed 29 June 2023.

17International Financial Reporting Standard 1 (IFRS 1). First-time Adoption of International Financial Reporting Standards (as amended of 01 January 2012) https://zakon.rada.gov.ua/laws/show/929_004 accessed 29 June 2023.

18SMIDA https://smida.gov.ua accessed 29 June 2023.

19Order of the Ministry of Finance of Ukraine No 73 ‘On approval of the National Regulation (Standard) of Accounting 1 “General Requirements for Financial Reporting”’ of 7 February 2013 (as amended of 17 February 2023) https://zakon.rada.gov.ua/laws/show/z0336-13#Text accessed 29 June 2023.

20Compiled by the authors.

21Сompiled by the authors on the basis of data from financial statements of enterprises. See, SMIDA (n 18).

REFERENCES

-

Alon A, ‘The IFRS Question: To Adopt or Not?’ in Feldmann D and Rupert TJ (eds), Advances in Accounting Education: Teaching and Curriculum Innovations (Advances in Accounting Education vol 13, Emerald Group Publishing Limited 2012) 405, doi:10.1108/S1085-4622(2012)0000013021.

-

Ball R, Li X and Shivakumar L, ‘Contractibility and Transparency of Financial Statement Information Prepared under IFRS: Evidence from Debt Contracts around IFRS Adoption’ (2015) 53(5) Journal of Accounting Research 915, doi:10.1111/1475-679X.12095.

-

Barth ME and others, Accounting Quality: International Accounting Standards and US GAAP (Working paper series, Stanford University and University of North Carolina 2006).

-

Iatridis G, ‘International Financial Reporting Standards and the Quality of Financial Statement Information’ (2010) 19(3) International Review of Financial Analysis 193, doi:10.1016/j. irfa.2010.02.004.

-

Kharlamova O, ‘Crisis “Markers” in the Controlling System of IFRS-Reporting Preparation’ (2015) 3-4(2) Economic Annals-XXI 71.

-

Kuzina RV, ‘Harmonization of Financial Reporting: International Experience and Ukrainian Practice’ (2012) 721 Bulletin of the National University “Lviv Polytechnic” 126.

-

Liu C and others, ‘The Impact of IFRS on Accounting Quality in a Regulated Market: An Empirical Study of China’ (2011) 26(4) Journal of Accounting, Auditing & Finance 659, doi:10.1177/0148558X11409164.

-

Lovinska L, ‘The Impact of European Integration Processes on the Development of Accounting and Reporting in Ukraine’ (2014) 9 Finance of Ukraine 21.

-

Müller VO, ‘The Impact of IFRS Adoption on the Quality of Consolidated Financial Reporting’ (2014) 109 Procedia Economics and Finance 976, doi:10.1016/j.sbspro.2013.12.574.

-

Palea V, ‘IAS/IFRS and Financial Reporting Quality: Lessons from the European Experience’ (2013) 6(4) China Journal of Accounting Research 247, doi:10.1016/j.cjar.2013.08.003.

-

Păşcan ID, ‘Measuring the Effects of IFRS Adoption on Accounting Quality: A Review’ (2015) 32 Procedia Economics and Finance 580, doi:10.1016/S2212-5671(15)01435-5.

-

Piechocka-Kaluzna A, ‘Measuring The Quality of Financial Statements After the Conversion to IFRS, Case of Poland’ [2021] Journal of Financial Studies and Research 479868, doi:10.5171/2021.479868.

-

Procházka D, ‘The Development of Capital Markets of New EU Countries in the IFRS Era’ (2015) 25 Procedia Economics and Finance 116, doi:10.1016/S2212-5671(15)00720-0.

-

Psaros J and Trotman KT, ‘The Impact of the Type of Accounting Standards on Preparers Judgments’ (2004). 40(1) Abacus 76, doi:10.1111/j.1467-6281.2004.00144.x

-

Ramanna K and Sletten E, Why Do Countries Adopt International Financial Reporting Standards? (Working Papers 09-102, Harvard Business School 2009).

-

Shulga T and others, ‘Introduction of International Financial Reporting Standards in Ukraine: Problems and Prospects’ (2019) 8(21) Amazonia Investiga 341.

-

Shvets V, ‘On the Issue of Legal and Regulatory Provision of Accounting and Financial Reporting under IFRS’ (2015) 10(175) Bulletin of the Taras Shevchenko National University of Kyiv, Economics 60.

-

Tendeloo B van and Vanstraelen A, ‘Earnings Management under German GAAP Versus IFRS’ (2005) 14(1) European Accounting Review 155, doi:10.1080/0963818042000338988.

-

Uyar M, ‘The Impact of Switching Standard on Accounting Quality’ (2013) 9(4) Journal of Modern Accounting and Auditing 459.

-

Vallišová L and Dvořáková L, ‘Implementation of International Financial Accounting Standards from the Perspective of Companies in the Czech Republic’ (2018) 167(9-10) Economic AnnalsXXI 70, doi:10.21003/ea.V167-14.

-

Zhuravka F, ‘Problem aspects of transformation in financial reporting of business entities in Ukraine’ (2017) 1(1) Geopolitics under Globalization 36, doi:10.21511/gg.01(1).2017.05.

Authors information

Zasadnyi Bogdan

Dr. Sc. (Economics), Associate Professor, Head of the Department of Accounting and Auditing, Taras Shevchenko National University of Kyiv, Ukraine b_zasadnyi@knu.ua https://orcid.org/0000-0002-5308-7248

Corresponding author, responsible for writing abstract and methodology of article (Use Credit taxonomy). Competing interests: Any competing interests were included. Disclaimer: The authors declare that their opinions and views expressed in this manuscript are free of any impact of any organisations. Translation: The content of this article was translated by Tsybulnyk M.

Mykhalska Olena

Ph.D. (Economics), Assoc. Prof. at the Department of Accounting and Auditing, Taras Shevchenko National University of Kyiv, Ukraine o.mykhalska@knu.ua https://orcid.org/0000-0003-1921-6293

Co-author, responsible for literature review.

Feshchenko Yevgenia

Ph.D. (Economics), Assoc. Prof. at the Department of Accounting and Auditing, Taras Shevchenko National University of Kyiv, Ukraine feschenko@knu.ua https://orcid.org/0000-0002-5673-7672

Co-author, responsible for results

Tsybulnyk Maria

Ph.D. (Economics), Assistant at the Department of Accounting and Auditing, Taras Shevchenko National University of Kyiv, Ukraine m.tsybulnyk@knu.ua https://orcid.org/0000-0001-5764-8017

Co-author, responsible for translation of article.

Sklyaruk Iryna

Ph.D. (Economics), Assoc. Prof. at the Department of Accounting and Auditing, Taras Shevchenko National University of Kyiv, Ukraine i.skliaruk@knu.ua https://orcid.org/0000-0003-1169-8443

Co-author, responsible for conclusions

About this article

Cite this article Zasadnyi B, Mykhalska O, Feshchenko E, Tsybulnyk M, Sklyaruk I ‘Assessment of the Quality of Transformation of Financial Reporting of Entities According to IFRS’ 2023 4 (21) Special Issue Access to Justice in Eastern Europe. https://doi.org/10.33327/AJEE-18-6.4SI-ra000214

Submitted on 01 Aug 2023 / Revised 12 Aug 2023 / Approved 24 Aug 2023

Published ONLINE: 20 Sep 2023 / Last Published: 01 Nov 2023

DOI https://doi.org/10.33327/AJEE-18-6.4SI-ra000214

Managing editor – Dr. Ganna KharlamovaEnglish Editor – Julie Bold.

Summary: 1. Introduction. — 2. Methodology. — 3. Results. — 4. Discussion. — 5. Conclusions.

Keywords: accounting, financial reporting, International Standards of Financial Reporting (IFRS), financial status, financial ratios, management of the activities of enterprises of the dairy industry of Ukraine.

Rights and Permissions

Copyright: © 2023 Zasadnyi B., Mykhalska O., Feshchenko E., Tsybulnyk M., Sklyaruk I. This is an open access article distributed under the terms of the Creative Commons Attribution License, (CC BY 4.0), which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.